How To Find A Summary Of Your Airbnb Earnings

Are you a Host on Airbnb looking for important information that you may need to file your tax return this year? Here’s a short step-by-step guide to help you find the Gross Earnings section of your Airbnb account.

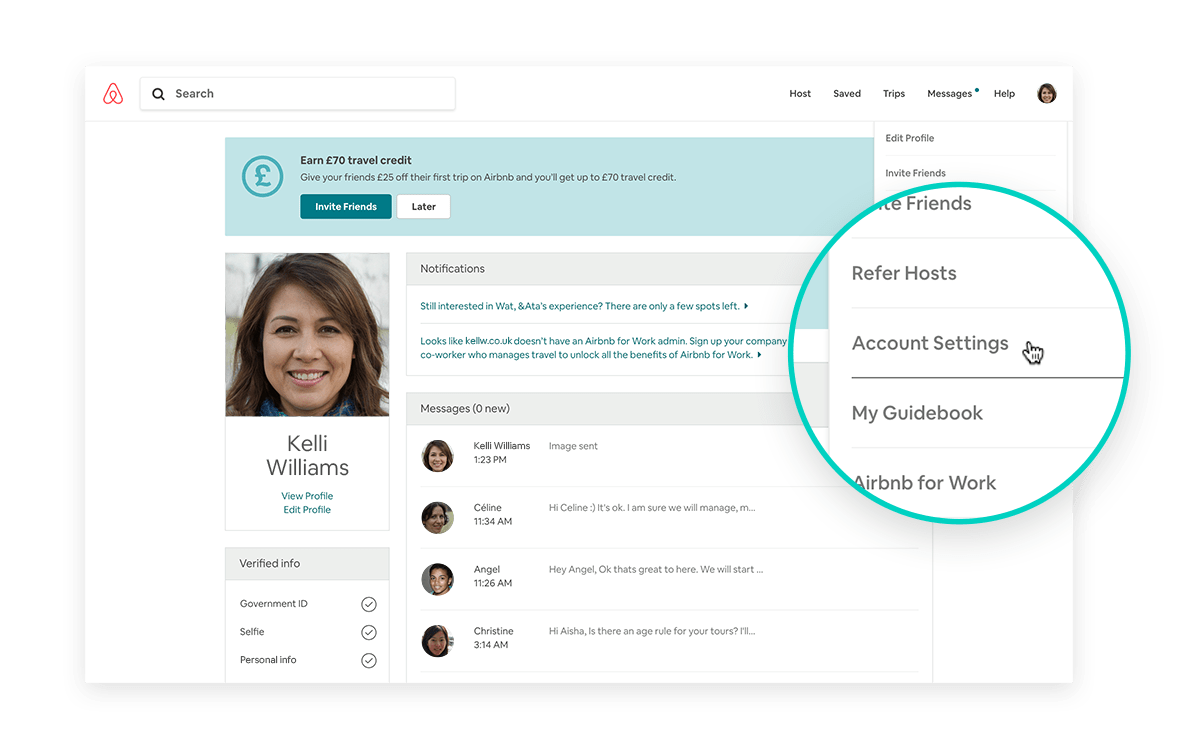

1. From the Airbnb home page, click on your profile picture at the top of the page to reveal a drop-down menu. Select “Account Settings” or “Settings”

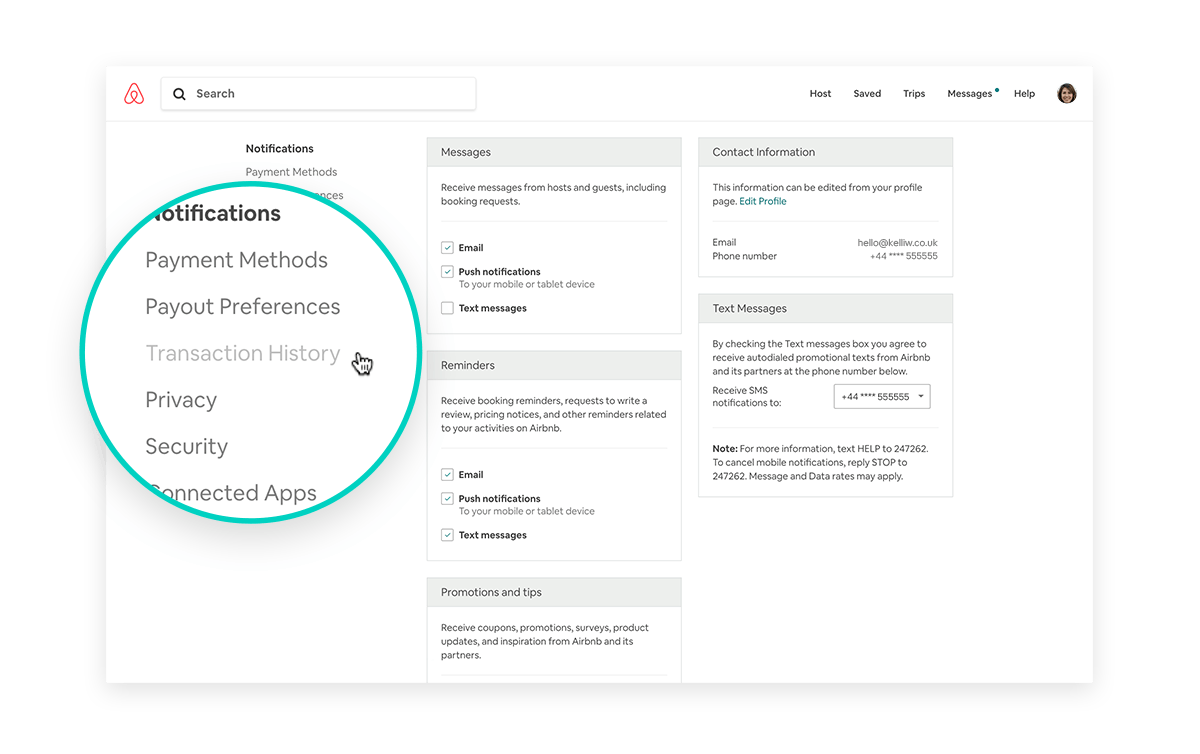

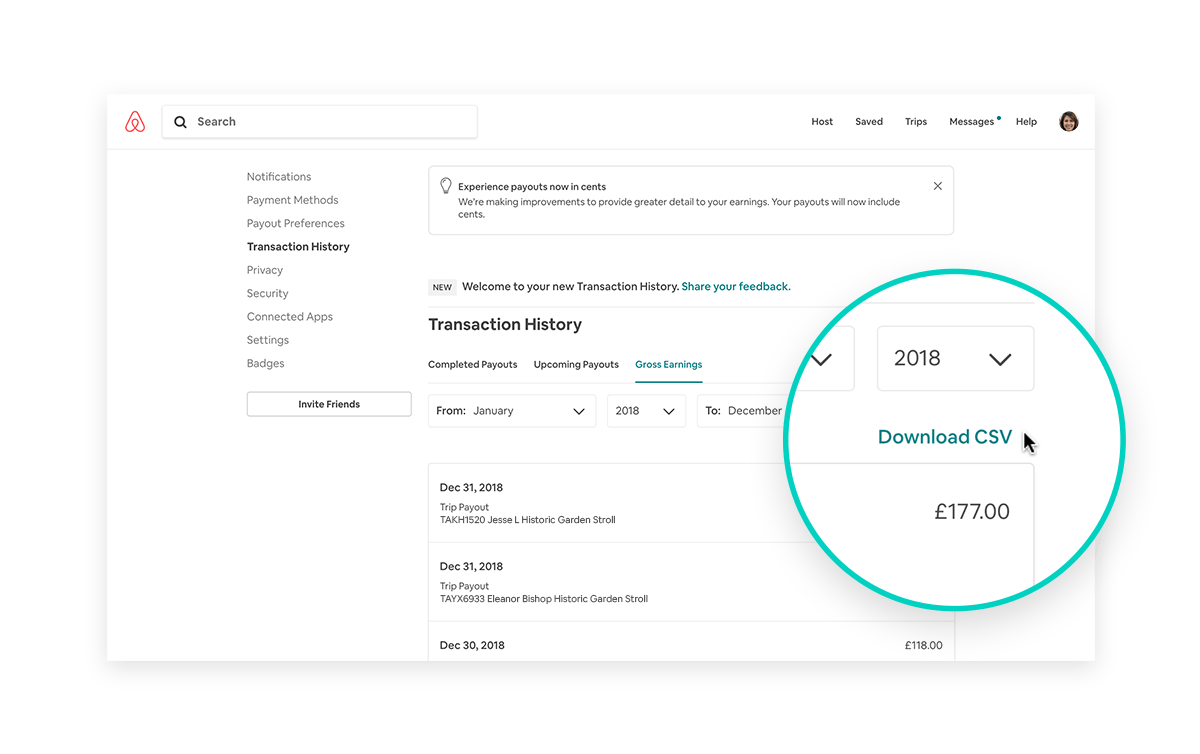

2. On the Account Settings page, select “Transaction History” from the left sidebar.

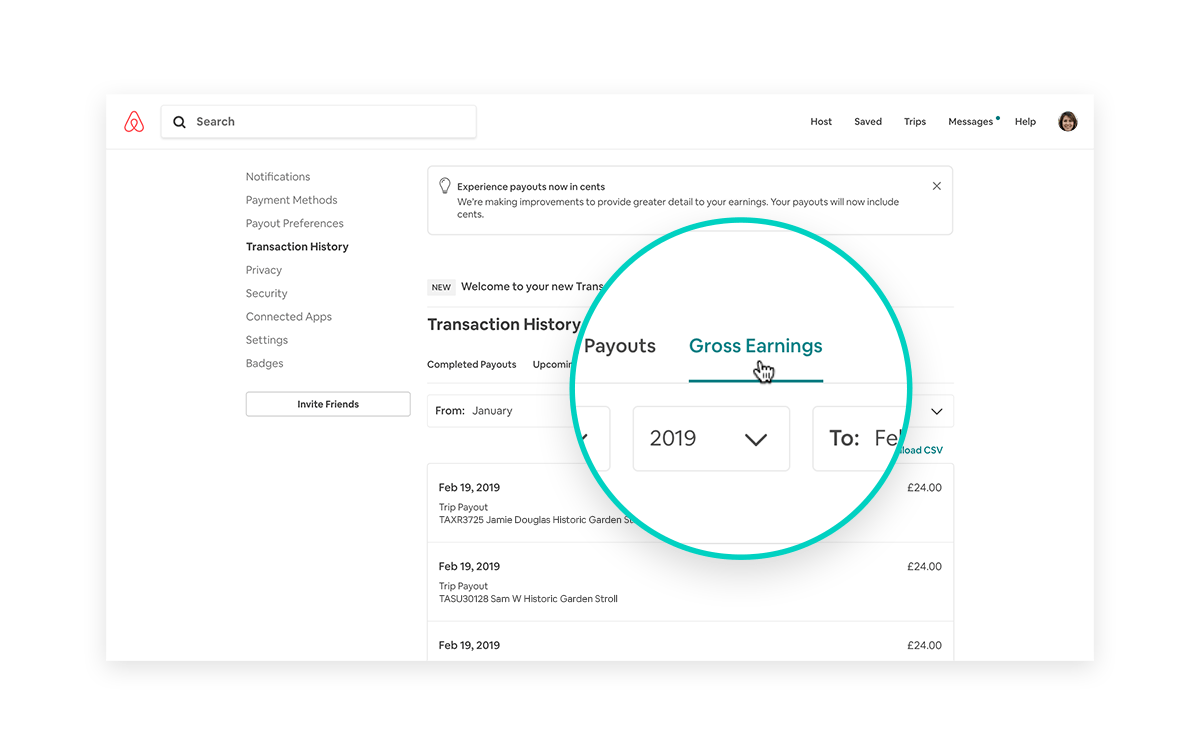

3. From the Transaction History page, select the “Gross Earnings” tab.

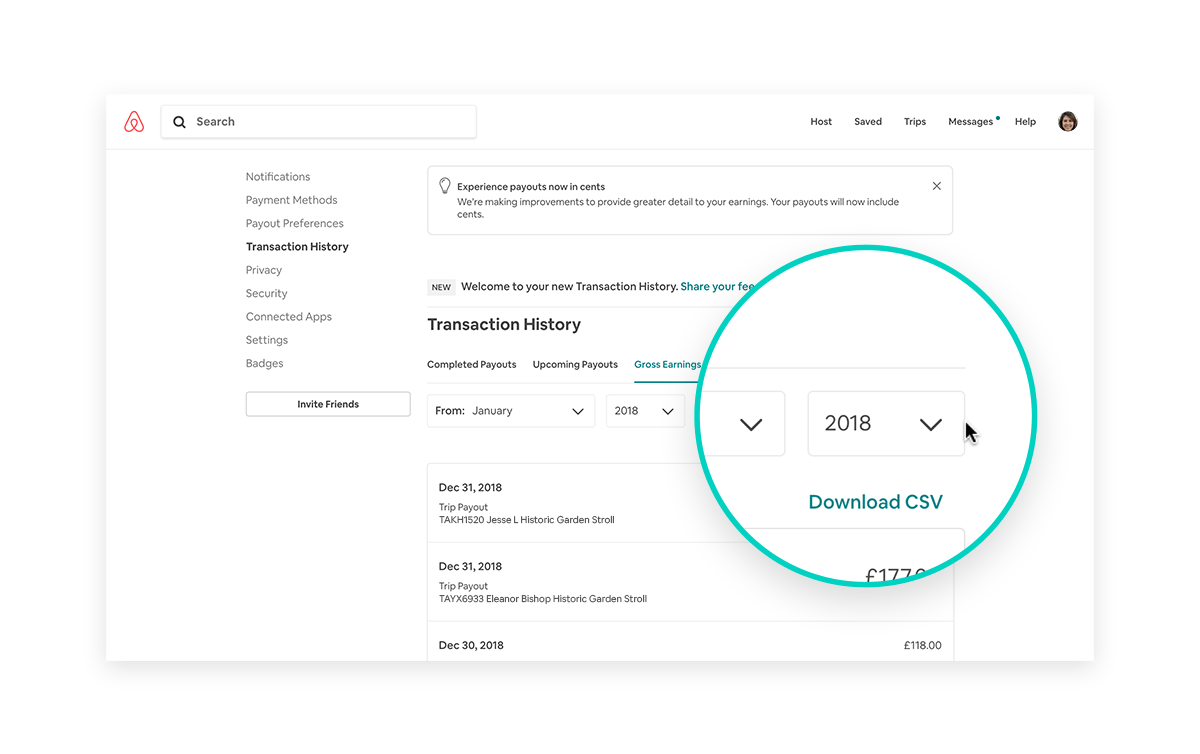

4. On the Gross Earnings tab, choose the time period you want to view by selecting the month and year in the “From” and “To” fields. For instance, if your tax year is January to December 2018, select these in the From and To fields.

5. To download and save a copy of this history for your tax filing purposes, select the “Download CSV”.

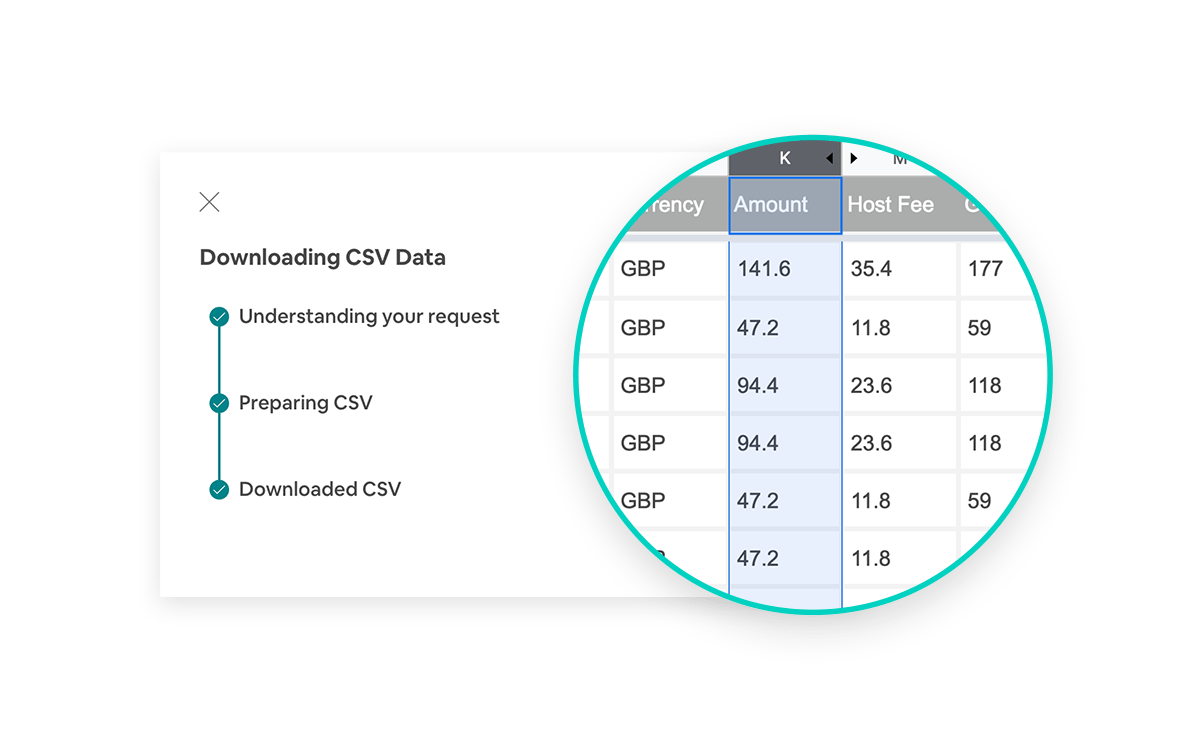

6. Open the CSV file in your preferred spreadsheet application. To calculate your earnings from hosting, add up all the numbers in the “Amount” column. The numbers in the Amount column represent your Gross Earnings (the listed price of your Experience) minus the Host Fee (the Airbnb service fee).

If you have any questions about how to report your Airbnb earnings, we recommend contacting a tax advisor in your area. You can also find helpful information on our UK Tax Hub.

*We recommend that you do your own research as this article isn’t comprehensive, and doesn’t constitute legal or tax advice. Also, as we don’t update this article in real time, please check each source and make sure that the information provided hasn’t recently changed.