How Airbnb Disperses Travel in the UK and Europe’s Major Cities

New data from Airbnb shows how travel on Airbnb is helping to disperse tourism in some of the UK’s most popular cities including London, Edinburgh, Manchester, Oxford, Cambridge and Liverpool.

The pandemic caused unprecedented disruption to global tourism. As international visitor numbers plummeted by more than 70 percent, we saw a profound shift in travel habits away from international trips and city breaks towards domestic travel and extended rural stays, as people sought to connect with each other safely and within covid regulations.

Many such travel trends have endured. In 2022, guests stayed in over 100,000 different cities and towns globally, and the top 10 most-visited destinations on Airbnb accounted for around 7% of all trips, compared to 10% in 2019. The number of communities globally where guests stayed increased by over 25% in 2022 compared with five years ago, diffusing tourism to new and different destinations. Since March 2020, more than 13,000 cities globally received their first booking on Airbnb.

As Airbnb continues to help disperse travel globally – and as we emerge from the pandemic and borders have reopened – people are once again returning to their favourite destinations, but in a more dispersed and sustainable way.

Airbnb is expecting more than 300 million guest arrivals this year and with summer on the horizon, more people are returning to cities and travelling overseas as post-pandemic travel confidence booms. In Q1 2023, for example, high density urban nights grew by more than 20% compared to the same period last year, and cross-border nights grew by more than a third.

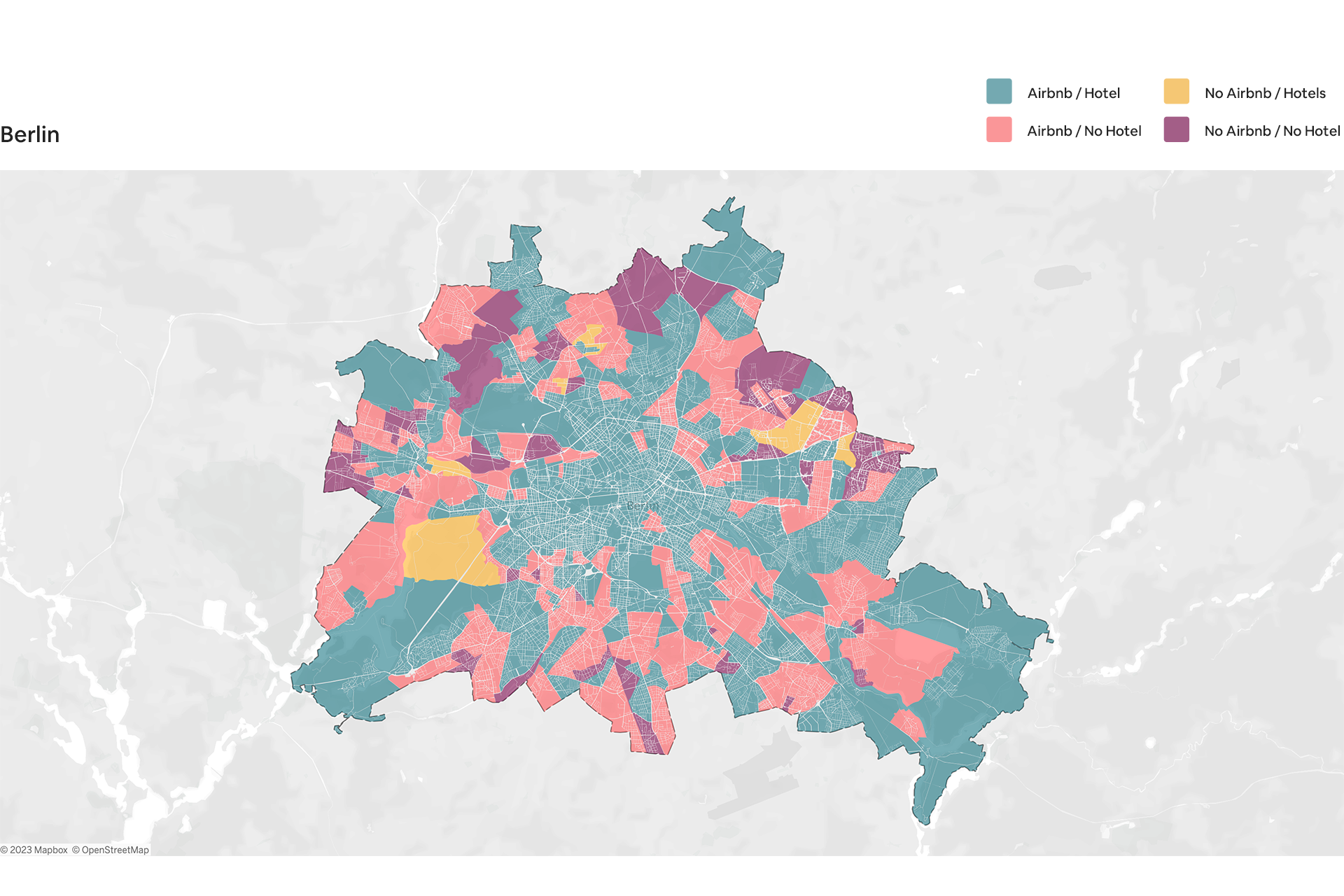

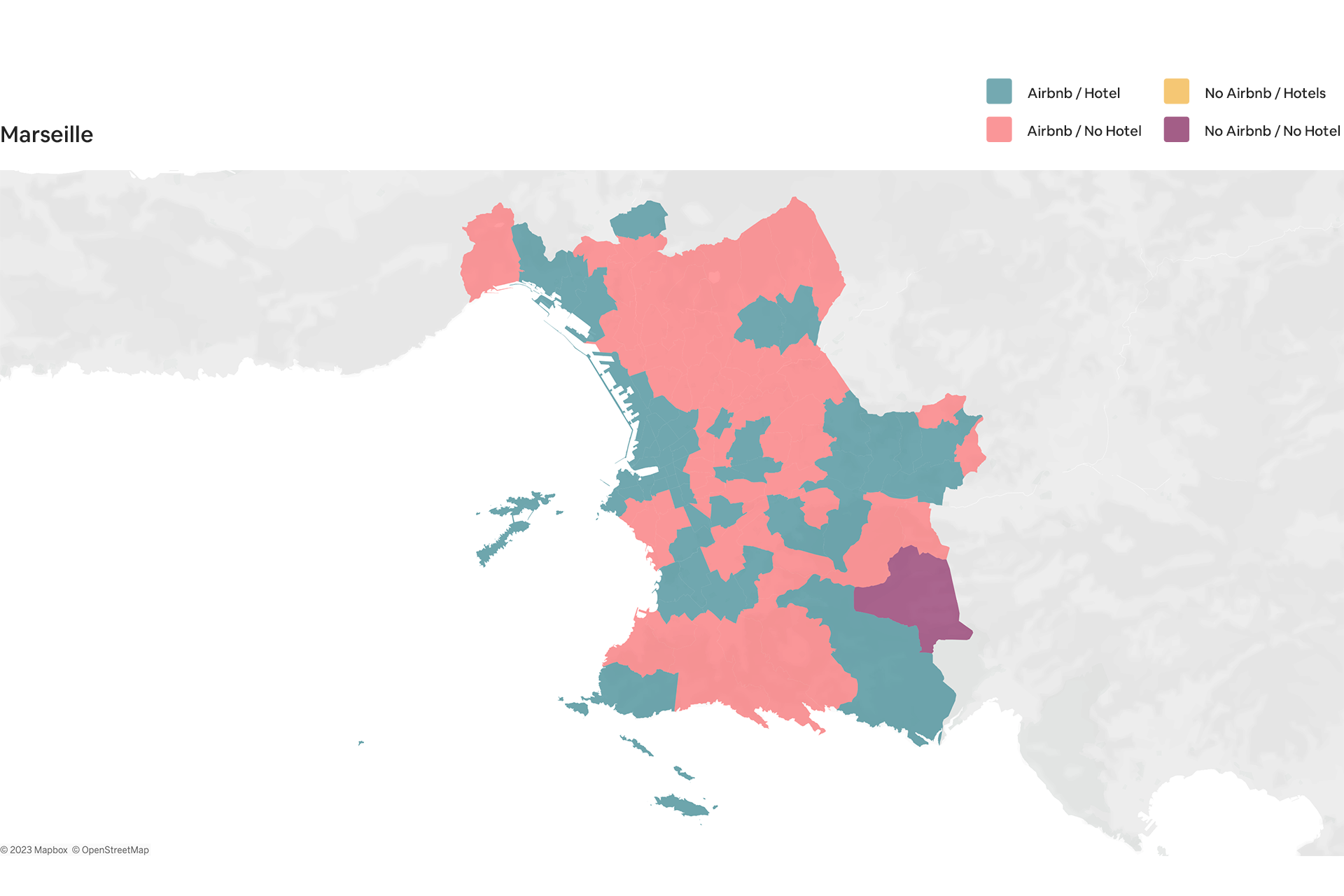

As guests return to cities, Airbnb is today sharing a first-ever analysis of Airbnb and OpenStreetMap data to highlight how the platform is supporting sustainable travel trends by dispersing guests and benefits within cities and beyond the world’s most oversaturated tourist hotspots to new, trending and less crowded communities, including many with no hotels, helping provide at least some relief from hotel-driven mass tourism trends.

Airbnb guests in major European cities

The nature and scale of the challenges posed by the growth of hotel-driven mass tourism are highlighted in a new report from Booking.com and Statista. While the report appears to champion the benefits of corporate hotel chains, it also points to a “boom” in hotel construction and conversion projects across Europe, which it says is coming at the cost of independently owned competitors – and that market prominence is “pushing relentlessly upward”. The report states that a small number of international hotel chains are driving the boom, with almost half of European hotel construction projects being driven by Accor, Hilton, Marriott and IHG. According to the report, France and the UK are now the first countries in Europe to witness “chainification” of their hotel industries, where the room share of chains has nearly doubled in just two decades. The report goes on to say that the growth of international hotel chains in Europe is “slowly eroding the share of independent properties in Europe”.

As cities grapple with the overtourism challenges triggered by the growth of hotel-driven mass tourism – where too many guests stay in too few places, largely at the same time – Airbnb is sharing new analysis of data from Airbnb and Eurostat, the statistical office of the European Union, that demonstrates how Airbnb guests continue to account for a small proportion of overall visitor numbers to Europe’s major cities, compared to guests using hotels and other accommodations.

Airbnb recognises the challenges posed by the growth of tourism in Europe – especially for Europe’s most popular cities – and we have always sought to be part of the solution to mass tourism trends.

We believe that dispersal is a key part of the solution to the challenges posed by mass tourism trends: distributing guests, income and benefits within and across destinations to less-crowded neighbourhoods within cities, and to places that don’t typically benefit.

And while the vast majority of visitors to Europe’s most overtouristed destinations stay in hotels, those that choose Airbnb are delivering disproportionately positive impacts for cities – including to communities with no hotels – while helping more guests access affordable accommodation options on Airbnb.

Dispersing guests and tourism benefits in the UK

Globally, listings on Airbnb are more dispersed than ever, and while hotels are concentrated in historic tourist hotspots, Airbnb is bringing pounds and tourism to diverse places not served by traditional hospitality, including in the UK.

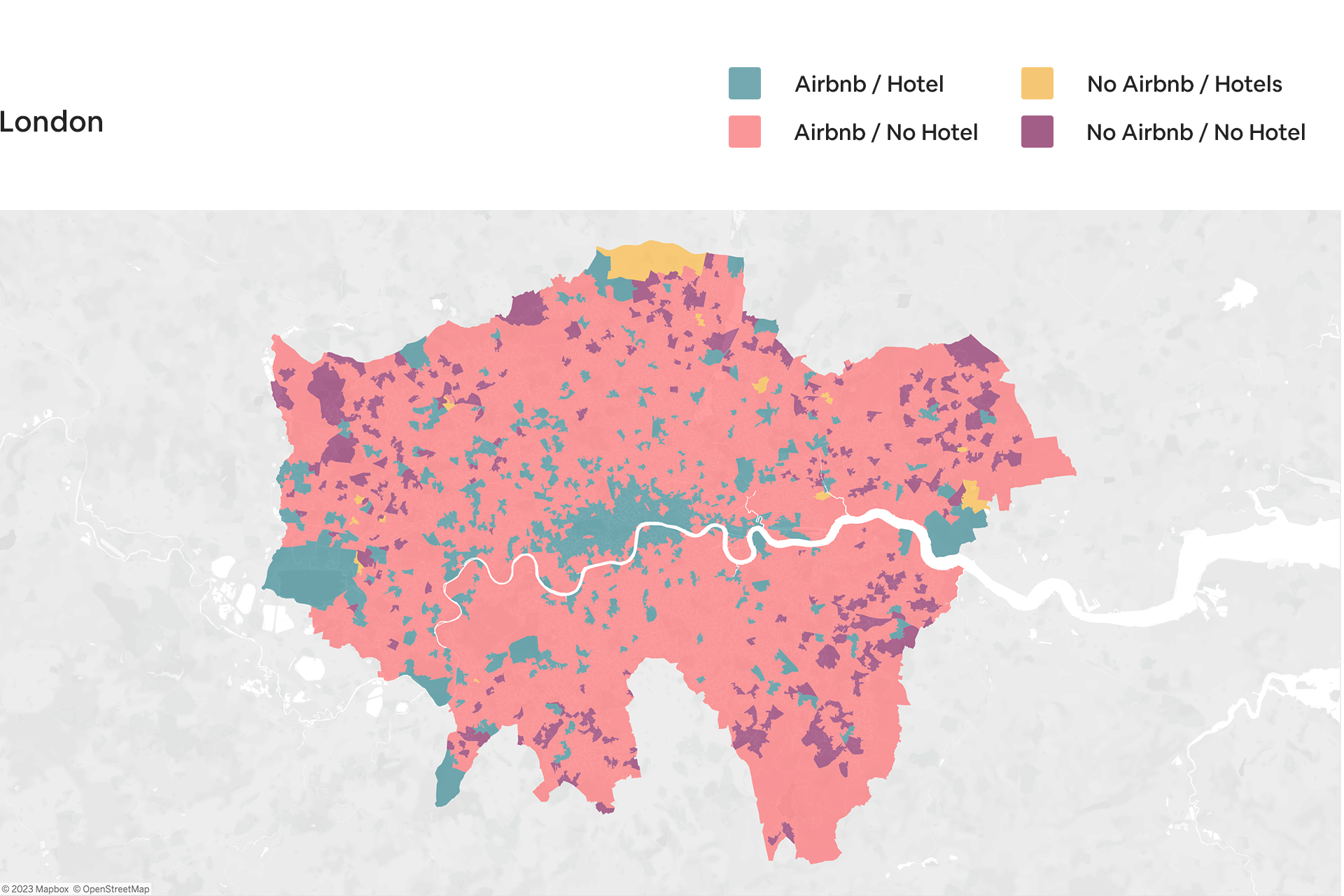

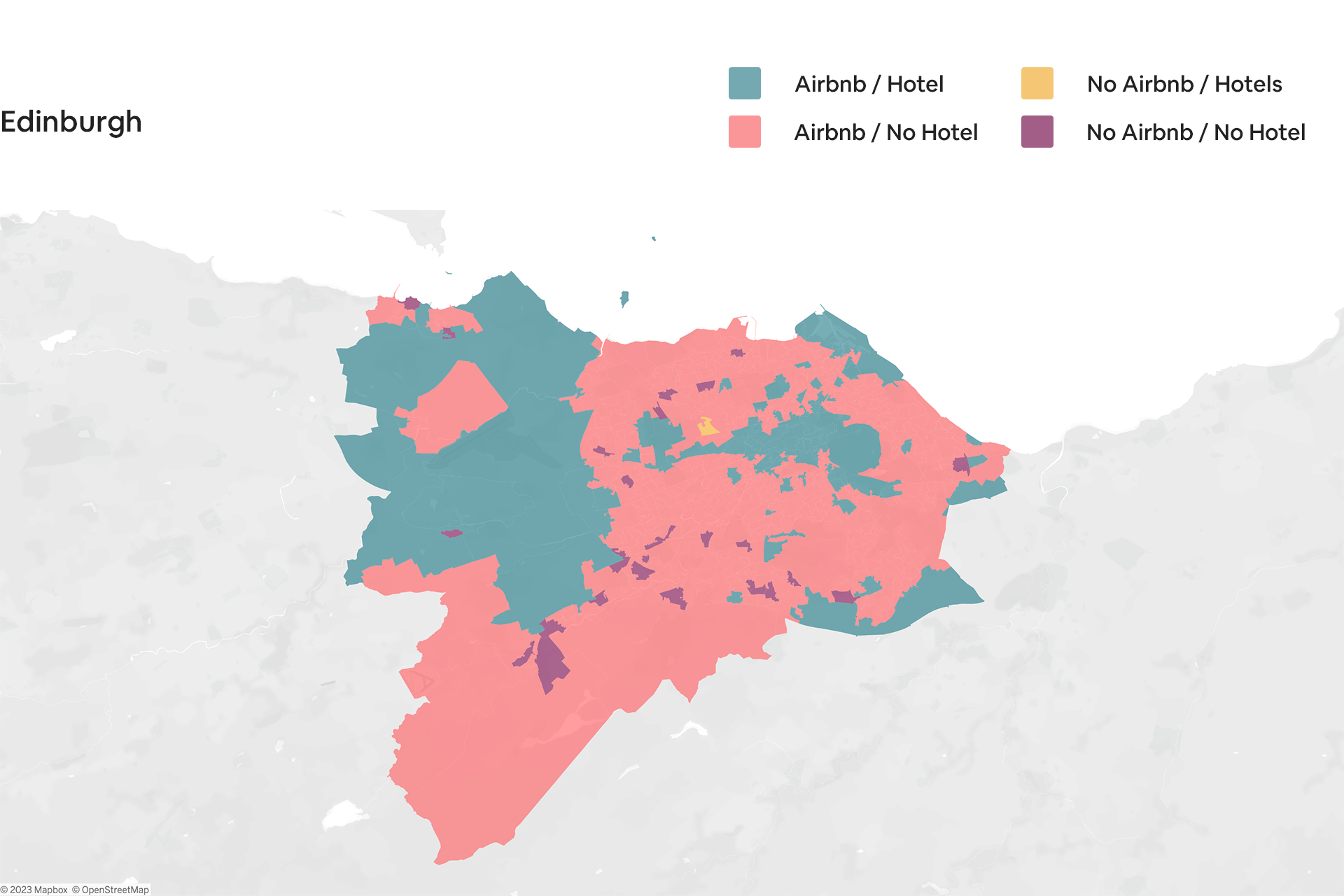

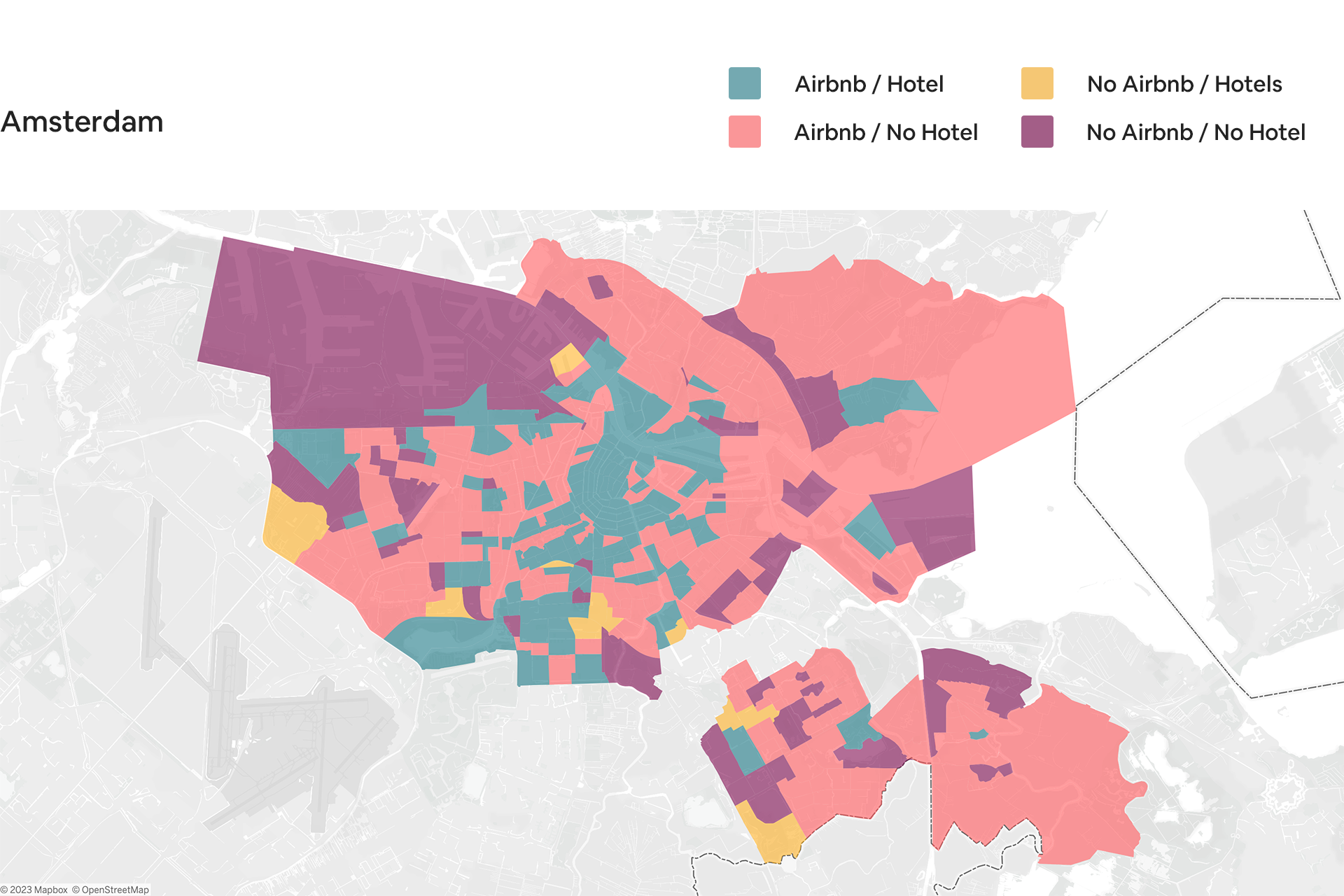

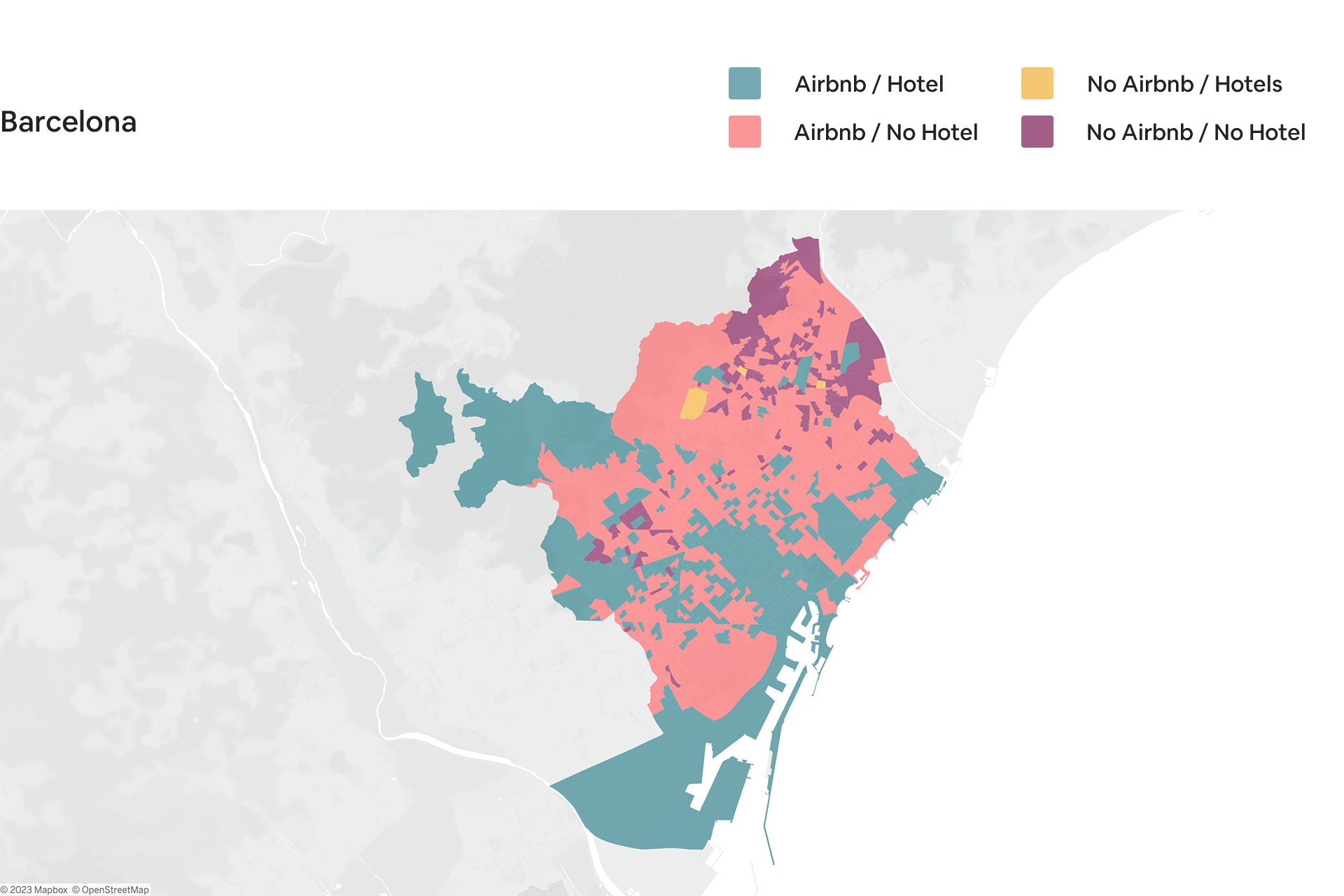

New data visuals for major UK cities, highlight how hotels tend to be clustered in the most overtouristed parts of cities, while listings on Airbnb are dispersed beyond tourist hotspots to areas that locals call home, generating new additional income for families, businesses and communities that have not typically benefited directly from tourism. This is a trend also seen in some of Europe’s largest cities.

Across the UK, there were nearly 7 million guest arrivals in communities with properties listed on Airbnb and no hotels in 2022, helping disperse guests away from overtouristed sections of cities and towards local families, who earned over $1.2 billion (over £973m) in Host earnings.

- In London, there were nearly 1 million guest arrivals at properties booked on Airbnb in areas with no hotels, earning local Hosts nearly $310 million (over £250m)

- In Edinburgh, there were over 285,000 guest arrivals at properties booked on Airbnb in areas with no hotels, earning local Hosts nearly $54 million (over £43m)

- In Manchester, there were over 175,000 guest arrivals at properties booked on Airbnb in areas with no hotels, earning local Hosts over $26 million. (over £21m)

- In Cambridge, there were over 140,000 guest arrivals at properties booked on Airbnb in areas with no hotels, earning local Hosts over $25 million (over £20m)

- In Oxford, there were over 118,000 guest arrivals at properties booked on Airbnb in areas with no hotels, earning local Hosts over $24 million (over £19m)

- In Liverpool, there were over 122,000 guest arrivals at properties booked on Airbnb in areas with no hotels, earning local Hosts over $14 million (over £11m)

As well as dispersing travel to new communities, the availability of accommodation on Airbnb is helping guests access affordable stays in these areas.

- In London, the average daily rate of stays in communities served by properties listed on Airbnb and no hotels was around $150 (over £120) compared to $230 (over £185) in communities served also by hotels, a difference of around $80 (nearly £65).

- In Edinburgh, the difference was around $56 (over £45) per night

- In Manchester, the difference was around $43 (nearly £35) per night

- In Cambridge, the difference was around $30 (nearly £25) per night

- In Oxford, the difference was around $47 (nearly £40) per night

- In Liverpool, the difference was around $57 (over £47) per night

New and trending neighbourhoods in the UK

Guests on Airbnb are embracing travel dispersal and venturing far and wide to enjoy authentic travel experiences in unique and undiscovered destinations. As well as helping disperse guests and benefits to communities with no hotels, Airbnb is helping guests discover new and trending neighbourhoods in the UK offering a more authentic and local experience, while spreading the benefits of tourism to local artisanal businesses.

Looking at the growth in nights booked in UK city neighbourhoods, here are some top trending urban communities for guests seeking more authentic travel experiences, beyond tourist hotspots:

- Bexley

- Havering

- Brent

- Sutton

- Newham

- Hounslow

- Enfield

- Waltham Forest

- Haringey

- Hackney

Tech-driven solutions to disperse travel

Airbnb wants to be part of the solution to challenges associated with the growth of tourism in Europe and is investing in tech-driven solutions to help. New data released today shows the continued positive impact of Airbnb’s flexible search features, including Airbnb Categories and I’m Flexible, on diverting bookings away from Europe’s most saturated tourist hotspots in support of more sustainable travel trends.

New global data shows that guests booking stays using Airbnb’s flexible search features are significantly less likely to stay in the most popular destinations on Airbnb, compared to those booking via traditional search:

- Flexible bookers are 23% less likely to stay in the top 20 destinations on Airbnb

- Flexible bookers are 18% less likely to stay in the top 50 destinations on Airbnb

Airbnb’s flexible search features are also helping disperse guests within Europe’s most popular cities beyond popular tourist hotspots to traditionally less visited communities:

- In London, flexible bookers are more likely to stay outside of the City of London (+30% compared to traditional bookers) and less likely to stay in the most popular districts of Westminster and Camden (respectively, -20% and -15%).

- In Barcelona, flexible bookers are less likely to book in the two most popular areas of Eixample and Ciutat Vella than traditional bookers (respectively, -12.5% and -11%)

- In Amsterdam, flexible bookers more often stay outside the city’s inner limits (+40%) compared to traditional bookers.

- In Lisbon, flexible bookers are more likely to stay outside of the city centre compared to traditional bookers (+64%) and less likely to stay in the most touristic districts of Santa Maria Major and Mesericordia (respectively, -23% and -16%).

- In Prague, flexible bookers are less likely to book in the busy central District 1 area than traditional bookers (by -17%).

- In Rome, flexible bookers are less likely to book in the busy central District 1 area than traditional bookers (by -8%).

- In Paris, flexible bookers more often stay outside the city’s inner limits (+2.5%) compared to traditional bookers.

Amanda Cupples, General Manager for Northern Europe said:

“Travel on Airbnb is more dispersed than ever and with summer on the horizon, we are helping guests return to cities in a sustainable way. Airbnb is helping disperse guests, income and tourism benefits beyond hotel hotspots to new and trending destinations, including many with no hotels. We see the challenges posed by hotel-driven mass tourism trends in Europe and are investing in solutions to help, while helping guests discover new communities and generating new income streams for locals.”