New Michigan tourism proposal could deliver over $20M a year locally for essential services

Key Takeaways

- A new proposal to modernize the state’s accommodations fee framework could generate more than $20 million annually for Michigan local governments to fund critical public services.

- Almost 60% of Airbnb stays in the EU occur outside major cities, supporting rural economies and helping families, posted workers, and people relocating for work.

- Almost 60% of Airbnb stays in the EU occur outside major cities, supporting rural economies and helping families, posted workers, and people relocating for work.

Key Takeaways

- A new proposal to modernize the state’s accommodations fee framework could generate more than $20 million annually for Michigan local governments to fund critical public services.

- Almost 60% of Airbnb stays in the EU occur outside major cities, supporting rural economies and helping families, posted workers, and people relocating for work.

- Almost 60% of Airbnb stays in the EU occur outside major cities, supporting rural economies and helping families, posted workers, and people relocating for work.

A new proposal to modernize Michigan’s accommodations fee framework could generate more than $20 million in additional revenue for local governments. The recently introduced Essential Services Tax Enabling Act (House Bill 5140) would let Michigan’s cities, villages, and towns keep the economic benefits of tourism local – funding community priorities, such as public safety, road construction, and tourism promotion.

“Tourism depends on the local police, fire, and infrastructure that keeps our communities safe and welcoming, but those costs shouldn’t fall on local taxpayers alone. When people stay in lodging accommodations in Michigan, they should help support the services they rely on during their visits. This legislation gives parity on the burden of covering these costs, by allowing locals to decide if they would like to capture these funds to help pay for essential services. It strengthens local tourism efforts, and it’s fair and fiscally responsible.”

House Finance Committee Chairman Mark Tisdel (R, Rochester Hills)

“West Michigan communities work hard to keep our streets safe, our sidewalks maintained, and our vital services strong. Visitors enjoy the benefits of that work every day. This bill gives local residents the freedom to decide if some of those tourism dollars should stay here at home to support the essential services we all rely on.”

Co-Sponsor, Representative Stephen Wooden (D, Grand Rapids)

If adopted statewide, communities across Michigan could generate millions more in annual revenue through a 3 percent fee on all accommodations. The proposed plan would also require all accommodation services to collect and remit the state sales tax, a practice Airbnb and certain Michigan counties voluntarily agreed to do starting in 2017 and which generated $27 million last year.

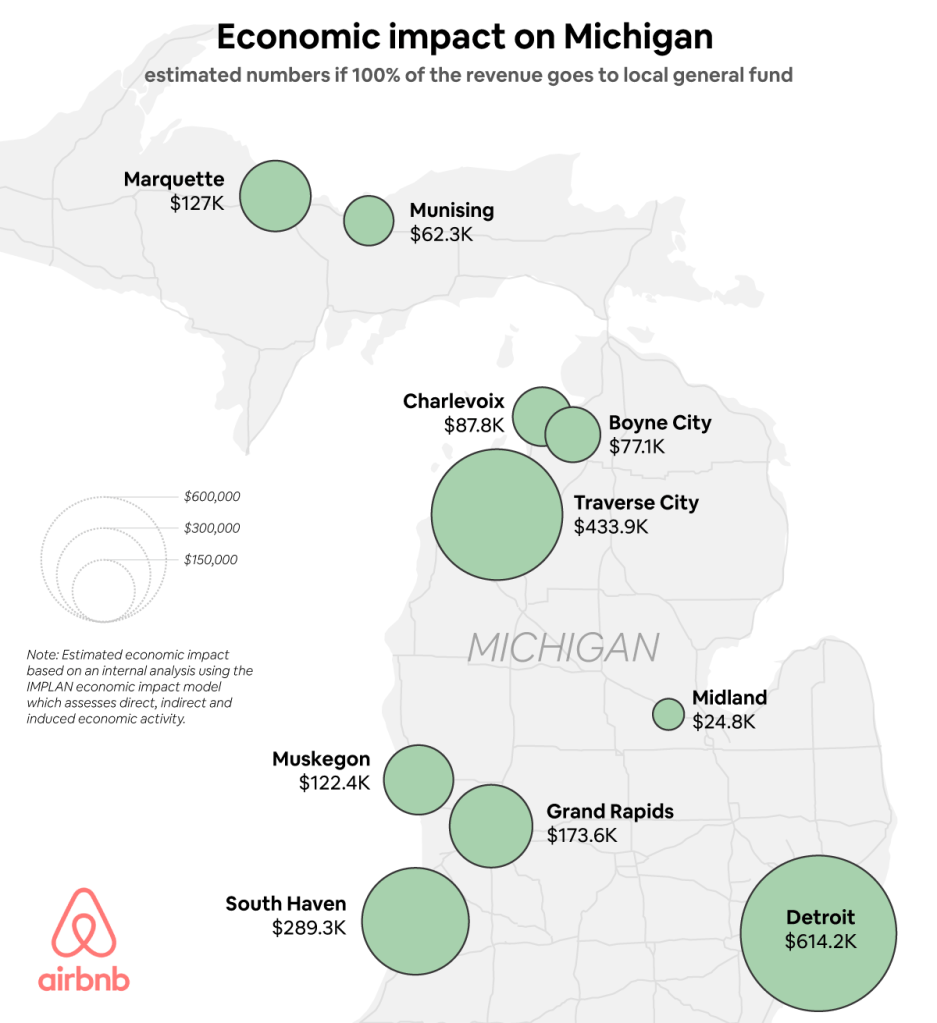

Based on 2024 estimates, larger cities and smaller towns alike would see meaningful returns for hosting visitors:

If you host it, you keep it

The proposal is simple – if you host it, you keep it. When travelers visit Detroit’s sports and music venues, stroll Grand Rapids’ art exhibits, spend summer weekends along Muskegon’s beaches, or chase fall colors through the Upper Peninsula, their stays and spending fuel local economies. In 2024 alone, over 2.1 million Airbnb guests stayed across Michigan, including in communities without hotels. This travel generated $1.3 billion in economic activity, $355 million in tax revenue, and supported 17,500 jobs. Yet under the state’s current accommodations sales tax framework, most cities, villages, and towns receive none of that tourism revenue.

Under a modern framework, Michigan communities would be authorized to levy a fee on all accommodations. They would then have the option to use up to 100 percent of the revenue they receive to invest in their infrastructure and grow their economy. In addition to the fee of up to 3 percent, the proposal also includes a provision that requires locals to report how the funds are used to ensure public transparency..

With listings and visitors in every corner of Michigan – including across rural, urban, and suburban areas – the modernized framework can provide municipalities with increased revenue at a time of budget and economic uncertainty.

Michigan’s tourism economy is growing fast. This plan builds on that momentum by ensuring that when visitors choose to stay in Michigan communities, more of the economic benefits stay with them, and in turn these communities can reinvest that revenue into critical services for residents. It’s a simple step towards a fairer, more sustainable tourism economy – one that works for every community.

Statements from local leaders

“Traverse City welcomes thousands of visitors each year to enjoy our world-class entertainment, food, and natural beauty. But those visitors also rely on the same public infrastructure and essential services our residents fund. This legislation gives us a fair, local tool to help offset those costs, improve quality of life for our community, and allow visitors to give back to the place they love to visit. It’s about choice- local voters decide if the community will opt-in.”

Traverse City Mayor Amy Shamroe

“We take pride in being Yoopers. We’re different in a lot of ways, but our challenges are the same as any other Michigan community. Visitors love coming to Marquette, but the costs of keeping our city running falls on our residents. This bill is a common-sense way to make sure visitors help share in those costs.

Marquette Mayor Jessica Hanley

“Royal Oak is a vibrant community because of the people who make it that way, both residents and visitors. This legislation gives visitors a stake in maintaining the quality and character that make Royal Oak so special. As both a mayor and vacation property owner, I believe local tax dollars should first support the services our community relies on, not just promote more tourism. This bill helps strike that balance and allows communities to choose to spend that money in the most effective way.”

Royal Oak Mayor Michael Fournier

“The Michigan Association of Chiefs of Police is proud to support the Essential Services Enabling Act. Tourism is vital to Michigan’s economy, but it also increases the demands on local law enforcement. This legislation gives communities a fair, transparent way to reinvest visitor dollars into essential public safety services that will strengthen the resources that keep both residents and visitors safe.”

Michigan Association of Chiefs of Police Executive Director Ron Wiles

“Fire services are essential and maintaining them isn’t cheap. No one wants to see outdated equipment or delayed response times when an emergency happens. This legislation gives local communities the option to direct a portion of tourism revenue toward maintaining and upgrading fire services, if they choose. It’s a straightforward, practical solution that supports public safety for everyone.”

Michigan Professional Fire Fighters Union President Matthew Sahr