Airbnb Collects Over $1 Billion in Tourism Taxes in the United States

Today we are announcing that Airbnb has collected $1.2 Billion in transient occupancy taxes (TOT) on behalf of our community globally, over $1 Billion of which has been collected in the United States. As part of our ongoing efforts around the world, Airbnb remains committed to working with governments to help our community collect and remit hotel type taxes. It is on track to become the World’s largest single collector of these taxes.

At the end of 2018 we announced that Airbnb had helped collect and remit more than $1 Billion in TOT globally and today we’re excited to not only update that number, but release new metrics about our tax collection efforts in the U.S.

New Partnerships

We’ve now partnered with more than 500 governments around the world (in addition to 23,000 localities in the country of France), collaboration and tourism promotion — including smaller cities like Half Moon Bay, California to states such as New Jersey, where we have remitted nearly $4 million in tax revenue since their new tax law went into effect last October.

Paying A Fair Share On More Bookings Worldwide

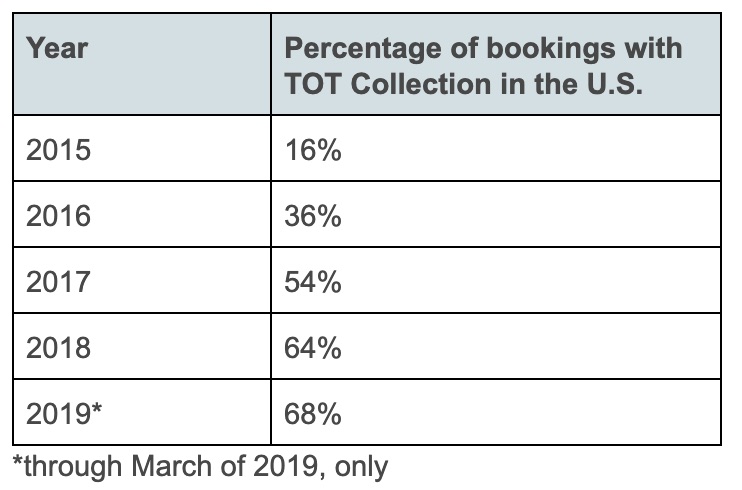

In 2014, Airbnb established its very first agreement to collect and remit hotel taxes in Portland, Oregon . Since then, our teams have worked tirelessly to establish hundreds of new agreements with local governments around the world., In 2019, 68 percent of bookings in the US i have occurred where Airbnb works with local governments to collect and remit TOT.

Partnerships with Nearly Every Top U.S. Market

TOT collections agreements don’t just provide a streamlined way for hosts to pay their taxes; they also provide a valuable revenue stream for cities where guests are traveling. Since Airbnb signed a collection agreement with the Los Angeles in 2016, over $100 million has helped pay for services like public safety, street repairs and trash removal. Los Angeles Mayor Eric Garcetti designated $5 million for affordable and low-income housing initiatives aimed at tackling the serious homelessness problem, which included funds for “rapid rehousing” programs.

In places where we do not currently have voluntary collection agreements, we will continue to actively seek the ability to do so — like in New York, where we are supporting legislation that will allow us to collect a number of taxes on behalf of hosts, generating upwards of $100+ million in annual revenue. We hope to one day work hand-in-hand with markets like New York to realize the full economic potential of short-term rentals while ensuring hosts can seamlessly fulfill their tax obligations.

Airbnb recently announced that there are more than 6 million listings worldwide, growth that is powered by our global network and growing community of hosts who keep the overwhelming majority of the price they charge for their listing. In March of 2019, we proudly celebrated another exciting and new milestone: half a billion guests have checked into Airbnb listings worldwide. As we look toward the future, it’s more important than ever that we continue to work with local governments to partner on fair and reasonable regulations and tax agreements that ensure streamlined revenue and a commitment to work together.

* Given the ability to collect and remit taxes in New York State, Airbnb estimates more than $100 million would be collected and remitted annually

** The city does not administer an applicable tax but Airbnb collects and remits for the corresponding county and/or state