Airbnb generated $1.6 billion in economic activity in San Diego in 2023

Key Takeaways

- Airbnb released a report showing hosts and guests in the San Diego metro area contributed an estimated $1.6 billion in economic activity in 2023.

- Hosts in the San Diego metro area helped support approximately 18,000 jobs and generate $453 million in total tax revenue.

Key Takeaways

- Airbnb released a report showing hosts and guests in the San Diego metro area contributed an estimated $1.6 billion in economic activity in 2023.

- Hosts in the San Diego metro area helped support approximately 18,000 jobs and generate $453 million in total tax revenue.

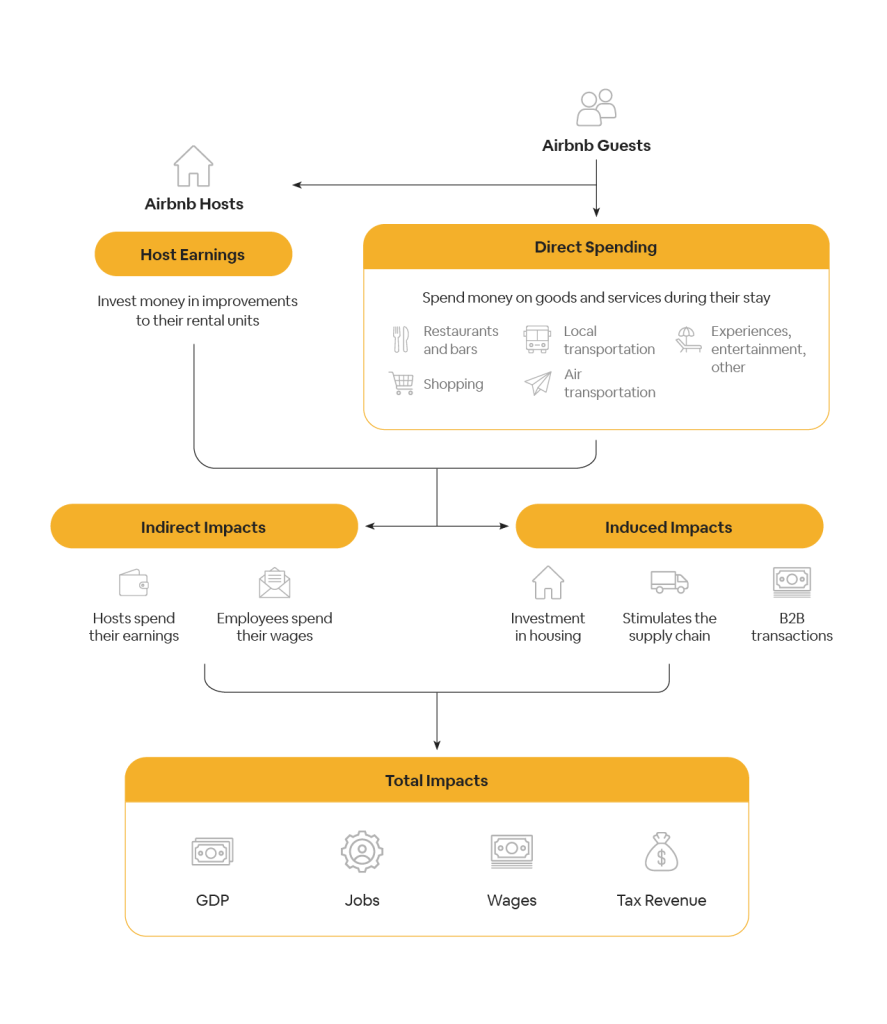

Airbnb released a new report showing hosts in the San Diego metro area welcomed nearly 1.7 million guests arrivals who contributed an estimated $1.6 billion in local economic activity in 2023.1

The report offers data-driven insights into the benefits home sharing brings to the greater San Diego area. By welcoming guests into their homes who then spend money at local businesses, hosts in the San Diego metro area helped support approximately 18,000 jobs2 and generated $453 million in total tax revenue3. This is in addition to the more than $34.7 million in local occupancy taxes contributed to the City of San Diego in 20234.

Hosting on Airbnb is also a vital source of supplemental income for local residents. According to a 2023 survey of hosts in the San Diego metro area, 54 percent said the income earned through hosting has helped them stay in their home, while 12 percent said hosting helped them avoid foreclosure or eviction.

“This new analysis underscores how home sharing is an important economic engine for the San Diego region, allowing residents to supplement their income while supporting tourism and providing more affordable options for travelers,” said Andrew Kalloch, Airbnb Director of Global Policy Development. “It will help inform our work with local leaders to ensure we continue to support solutions that balance the benefits of home sharing with community needs.”

The report comes at a time when travel spending in California has reached an all-time high, with new statewide data from Visit California showing short-term vacation rental visitor spending increased 1.5 percent compared to 2022.

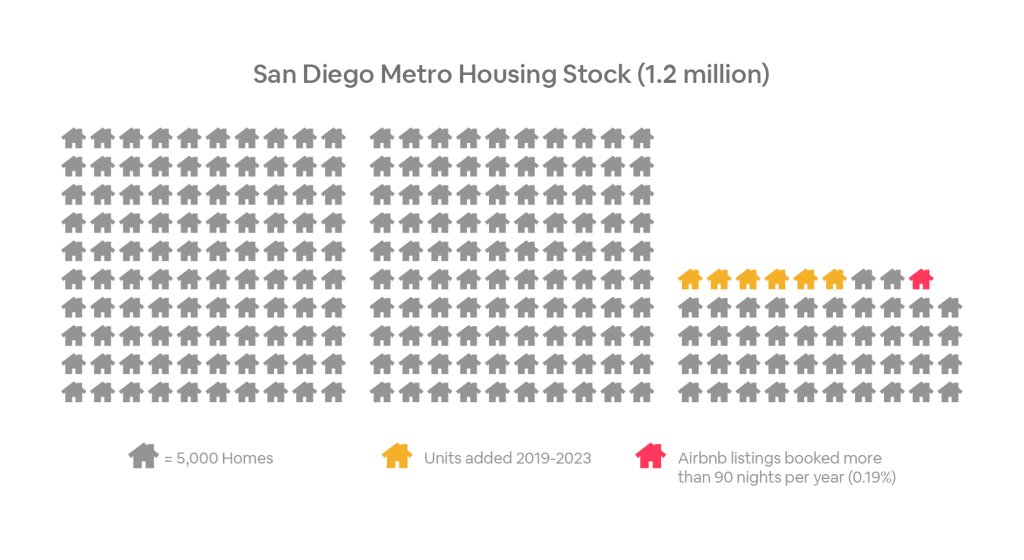

The report also analyzes the housing market in the greater San Diego area where the chronic underproduction of housing is the leading cause of rising housing costs. According to Airbnb’s analysis, 296,000 housing units would have needed to be added in the San Diego metro area over the last five years to stabilize rent growth at the rate of inflation, but only 30,000 units were actually constructed over that time.5 By contrast, entire home listings on Airbnb booked for more than 90 nights a year represent 0.5 percent of the San Diego metropolitan area’s 1.2 million housing units.6

Airbnb remains committed to partnering with San Diego leaders and pioneering innovative solutions to support responsible tourism. In 2020, we launched the City Portal to help cities better understand the Airbnb landscape in their communities and tools to help cities enforce their short-term rental laws. We partnered with city staff to expand the City Portal to San Diego in 2023 to support their enforcement and compliance efforts.

View the full report here.