DC renters and hosts call for renter-friendly short-term rental policy

Key Takeaways

- The majority of DC residents are renters, which means that the majority of DC residents are currently not allowed to access the economic benefits of sharing their space.

- New data shows that Airbnb hosts in DC welcomed more than 540,000 guest arrivals and contributed an estimated $307 million to the local economy in 2023.

- Nearly 70 percent of Airbnb listings in DC, for example, are located in census tracts with no hotels where Airbnb hosts are often the primary—if not the only—providers of local accommodation and tourism.

Key Takeaways

- The majority of DC residents are renters, which means that the majority of DC residents are currently not allowed to access the economic benefits of sharing their space.

- New data shows that Airbnb hosts in DC welcomed more than 540,000 guest arrivals and contributed an estimated $307 million to the local economy in 2023.

- Nearly 70 percent of Airbnb listings in DC, for example, are located in census tracts with no hotels where Airbnb hosts are often the primary—if not the only—providers of local accommodation and tourism.

As Washington, DC faces rising living costs and a growing number of cost-burdened renters, residents and Airbnb hosts are advocating for a renter-friendly short-term rental policy to offer relief. The City is currently considering a bill called the Tenant and Rowhouse Short-Term Rental Clarification Amendment Act, which would allow renters to share their home and enjoy the same financial benefits of short-term rentals as homeowners.

The vast majority of hosts in DC share their primary home on Airbnb, and many consider hosting an economic lifeline. According to a 2023 survey of hosts in DC, nearly 50 percent of hosts said they rely on the income they earn from hosting to make ends meet and afford to stay in their homes. This pending legislation would provide the same financial opportunity to renters and help them cover rising costs of living, all while supporting the city’s tourism economy.

“As a long-time DC resident and a host with a young family, I have seen firsthand how home-sharing can benefit residents and their communities. I strongly believe that everyone, regardless of whether they own or rent their home, should be allowed to home share. This bill will level that playing field and create new opportunities for renters who want to be hosts.”

-Brian, DC Resident and host

A boost to DC’s economy and more equitable tourism

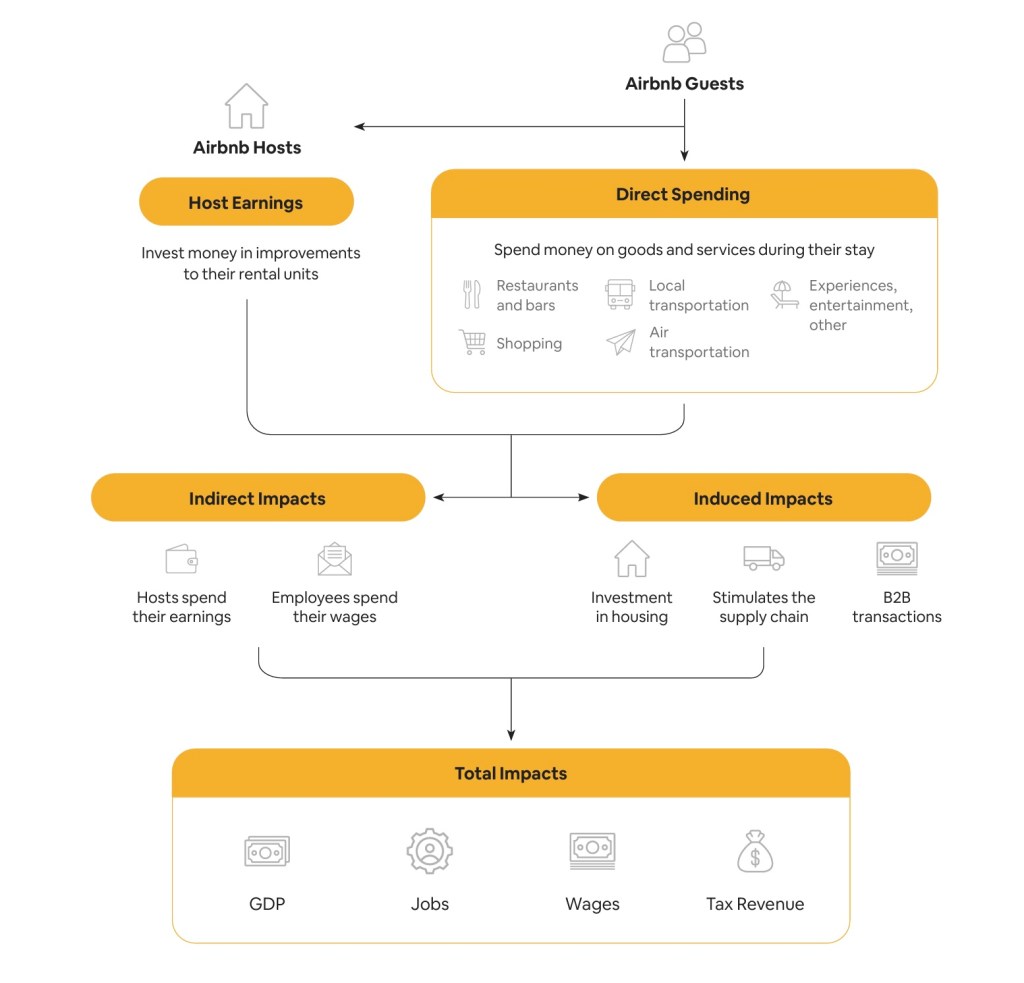

By expanding home sharing to renters, the entire DC economy stands to benefit. The majority of DC residents are renters, which means that the majority of DC residents are currently not allowed to access the economic benefits of sharing their space. New data shows that Airbnb hosts in DC welcomed more than 540,000 guest arrivals and contributed an estimated $307 million to the local economy1 in 2023. These guests spent money in local shops, restaurants, and businesses, creating jobs and supporting the city’s tourism industry. In total, Airbnb hosts in DC earned more than $124 million in 2023.

Key economic impacts include:

- 3,100 jobs supported by Airbnb hosts and guests.2

- $77 million in total tax revenue, including $20.3 million in local occupancy taxes.3

- $203 million in labor income generated by hosts and businesses catering to guests.4

What’s more, hosts play a key role in dispersing visitors beyond traditional tourist corridors. Nearly 70 percent of Airbnb listings in DC, for example, are located in census tracts with no hotels where Airbnb hosts are often the primary—if not the only—providers of local accommodation and tourism. Hosts in these areas without hotels earned nearly $60 million in 2022 from more than 245,000 guest arrivals.

“Airbnb has been nothing but positive for me. The extra income I earned from sharing my apartment helped me cover rising expenses, and I’ve had the pleasure of meeting the most interesting people along the way. The legal changes that made hosting impossible for me as a renter made living in DC, my home for 18 years, unaffordable and I sadly had to move. Everyone deserves the chance to participate in home sharing, just like homeowners.”

-Diane, Former DC Renter and host

National Precedent and Local Support for Tenant Hosting

In major U.S. cities like Atlanta, Charlotte, Cincinnati, Denver, Los Angeles, and San Francisco, tenants are allowed to host their homes on platforms like Airbnb. Within the DC region, tenants can apply for short-term rental permits in nearby areas like Arlington County, the City of Alexandria, and Montgomery County. As of July 1, 2024, Virginia enacted a statewide policy allowing tenants to apply for short-term rental licenses, provided they have written permission from their property owners. With cities across the nation embracing tenant hosting, DC has the opportunity to follow suit, ensuring renters benefit equally from home sharing and creating a more inclusive, economically resilient community.