How Airbnb disperses travel in Europe’s major cities

Key Takeaways

- A first-ever analysis of Airbnb and OpenStreetMap data shows how Airbnb is dispersing tourism in Europe's major cities to communities with no hotels.

- New analysis of data from Airbnb and Eurostat shows that Airbnb guests account for a small proportion of visitors to Europe's major cities, compared to guests using hotels and other accommodations.

- Airbnb's investment in flexible search features, including Airbnb Categories and I’m Flexible, are diverting bookings away from Europe’s most saturated tourist hotspots in support of more sustainable travel trends.

Key Takeaways

- A first-ever analysis of Airbnb and OpenStreetMap data shows how Airbnb is dispersing tourism in Europe's major cities to communities with no hotels.

- New analysis of data from Airbnb and Eurostat shows that Airbnb guests account for a small proportion of visitors to Europe's major cities, compared to guests using hotels and other accommodations.

- Airbnb's investment in flexible search features, including Airbnb Categories and I’m Flexible, are diverting bookings away from Europe’s most saturated tourist hotspots in support of more sustainable travel trends.

The pandemic caused unprecedented disruption to global tourism. As international visitor numbers plummeted by more than 70 percent1, we saw a profound shift in travel habits away from international trips and city breaks towards domestic travel and extended rural stays, as people sought to connect with each other safely and within covid regulations.

Many such travel trends have endured. In 2022, guests stayed in over 100,000 different cities and towns globally2, and the top 10 most-visited destinations on Airbnb accounted for around 7 percent of all trips, compared to 10 percent in 20193. The number of communities globally where guests stayed increased by over 25 percent in 2022 compared with five years ago, diffusing tourism to new and different destinations4. Since March 2020, more than 13,000 cities globally received their first booking on Airbnb5.

As Airbnb continues to help disperse travel globally – and as we emerge from the pandemic and borders have reopened – people are once again returning to their favorite destinations, but in a more dispersed and sustainable way.

Airbnb is expecting more than 300 million guest arrivals this year and with summer on the horizon, more people are returning to cities and traveling overseas as post-pandemic travel confidence booms. In Q1 2023, for example, high density urban nights grew by more than 20 percent compared to the same period last year, and cross-border nights grew by more than a third6.

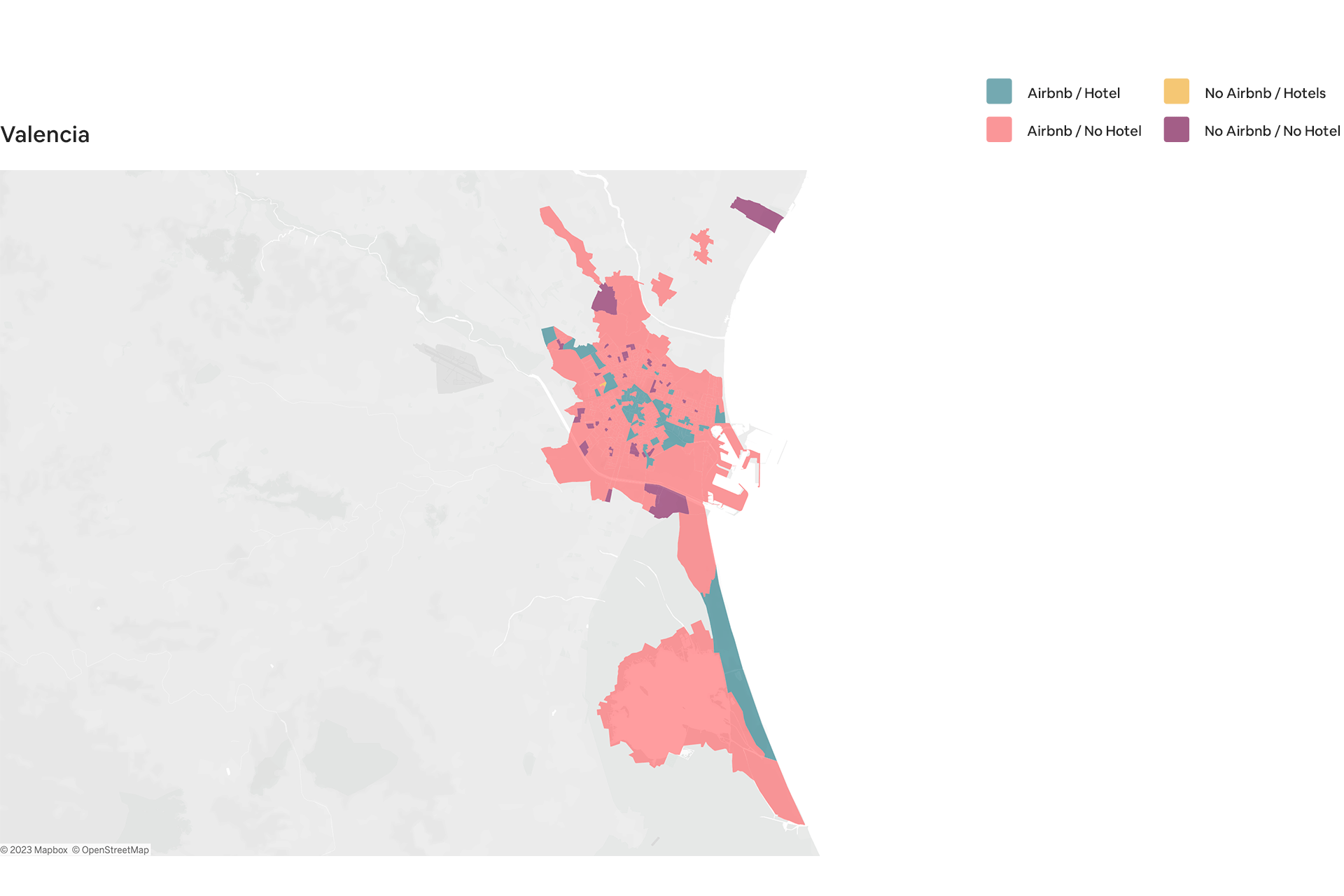

As guests return to cities, Airbnb is today sharing a first-ever analysis of Airbnb and OpenStreetMap7 data to highlight how the platform is supporting sustainable travel trends by dispersing guests and benefits within cities and beyond the world’s most oversaturated tourist hotspots to new, trending and less crowded communities, including many with no hotels, helping provide at least some relief from hotel-driven mass tourism trends.

Airbnb guests in major European cities

The nature and scale of the challenges posed by the growth of hotel-driven mass tourism are highlighted in a new report from Booking.com and Statista. While the report appears to champion the benefits of corporate hotel chains, it also points to a “boom” in hotel construction and conversion projects across Europe, which it says is coming at the cost of independently owned competitors – and that market prominence is “pushing relentlessly upward”. The report states that a small number of international hotel chains are driving the boom, with almost half of European hotel construction projects being driven by Accor, Hilton, Marriott and IHG. According to the report, France and the UK are now the first countries in Europe to witness “chainification” of their hotel industries, where the room share of chains has nearly doubled in just two decades. The report goes on to say that the growth of international hotel chains in Europe is “slowly eroding the share of independent properties in Europe.”

As cities grapple with the overtourism challenges triggered by the growth of hotel-driven mass tourism – where too many guests stay in too few places, largely at the same time – Airbnb is sharing new analysis of data from Airbnb and Eurostat, the statistical office of the European Union, that demonstrates how Airbnb guests continue to account for a small proportion of overall visitor numbers to Europe’s major cities, compared to guests using hotels and other accommodations8.

Airbnb recognizes the challenges posed by the growth of tourism in Europe – especially for Europe’s most popular cities – and we have always sought to be part of the solution to mass tourism trends.

We believe that dispersal is a key part of the solution to the challenges posed by mass tourism trends: distributing guests, income and benefits within and across destinations to less-crowded neighborhoods within cities, and to places that don’t typically benefit.

And while the vast majority of visitors to Europe’s most over-touristed destinations stay in hotels, those that choose Airbnb are delivering disproportionately positive impacts for cities – including to communities with no hotels – while helping more guests access affordable accommodation options on Airbnb.

Dispersing guests and tourism benefits in Europe

Globally, listings on Airbnb are more dispersed than ever, and while hotels are concentrated in historic tourist hotspots, Airbnb is bringing dollars and tourism to diverse places not served by traditional hospitality.

A new analysis of Airbnb and OpenStreetMap data in 10 popular European travel destinations shows that there were over 3 million guest arrivals in communities with Airbnbs and no hotels in 20229, helping disperse guests while generating over $710 million in Host earnings for local families10.

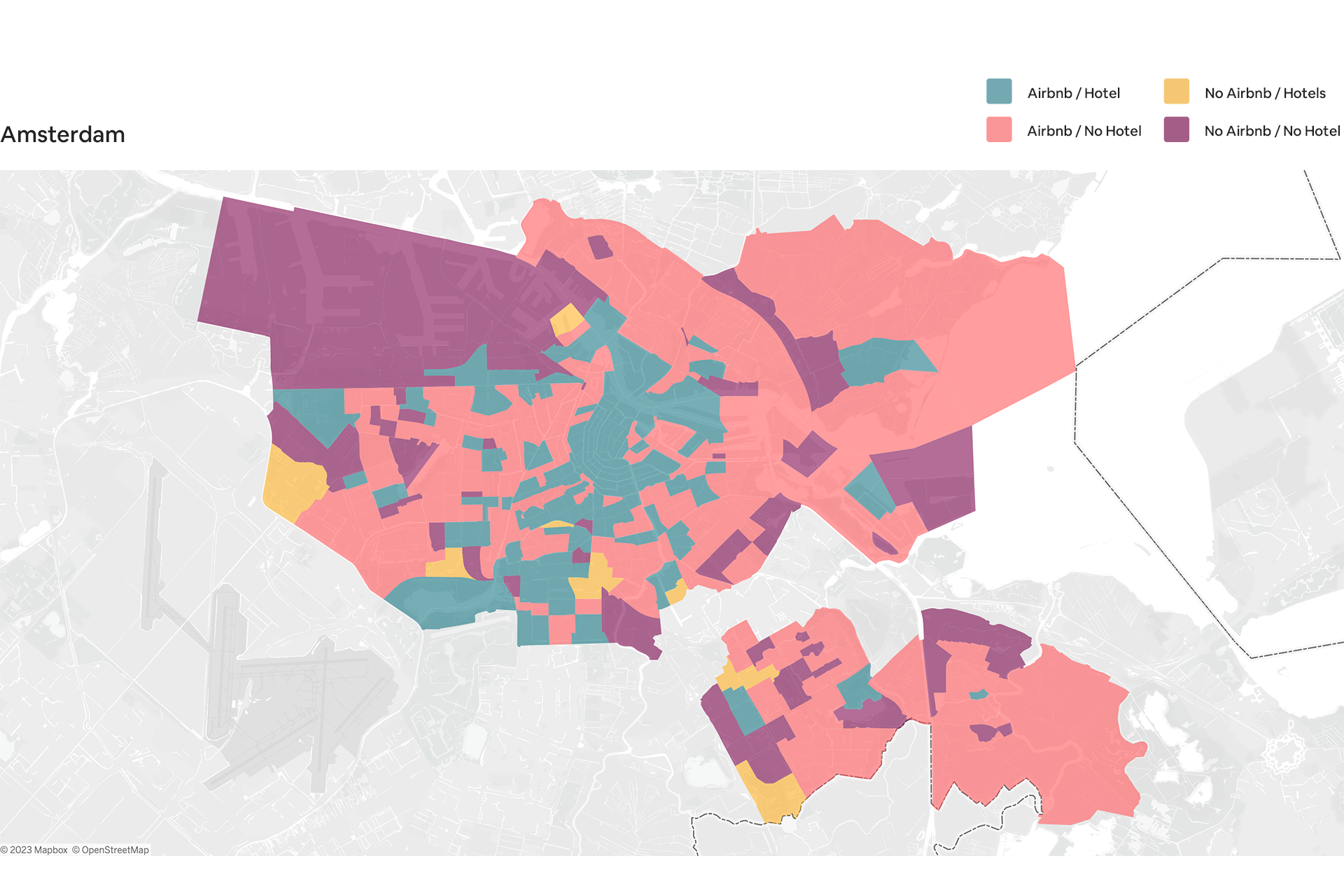

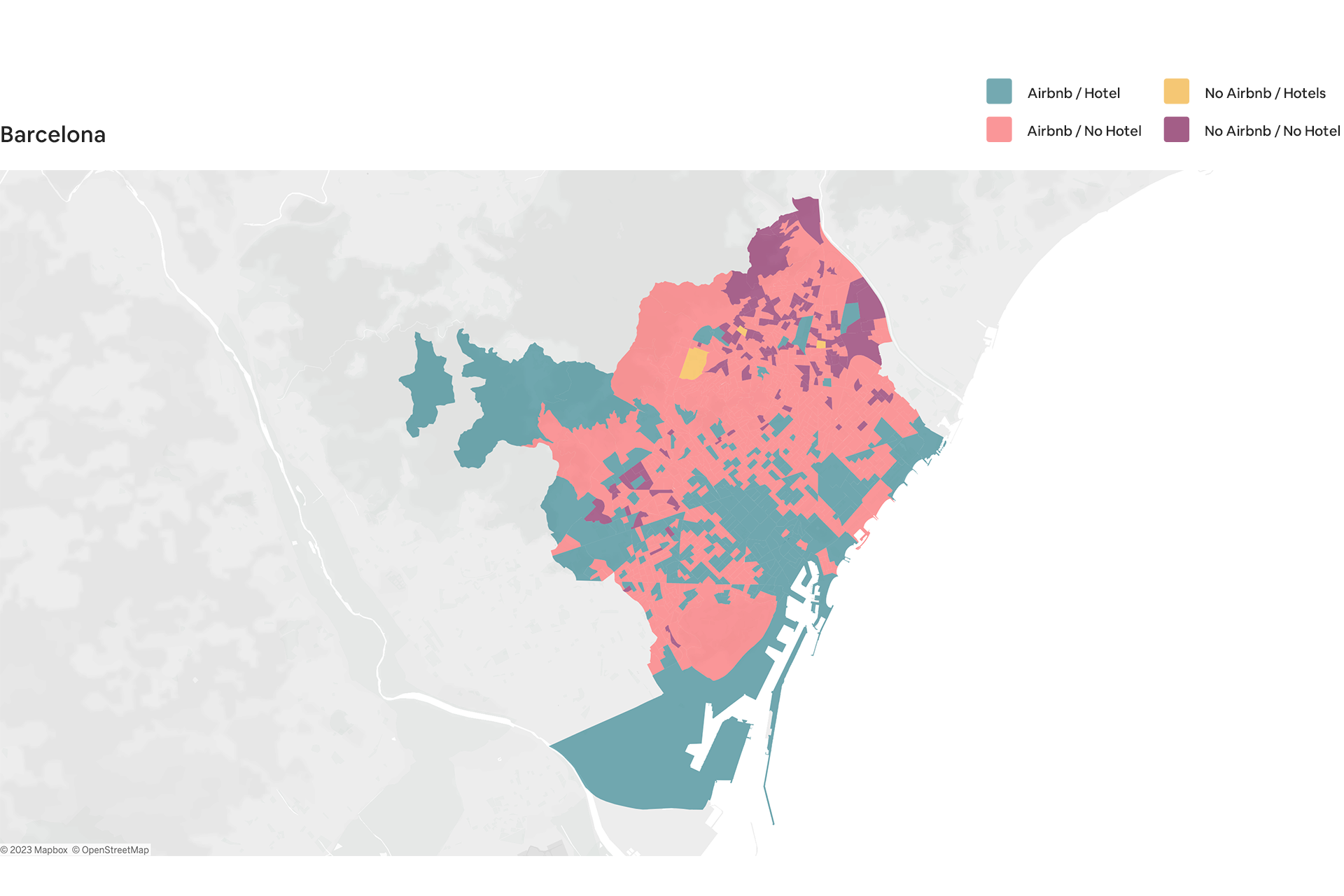

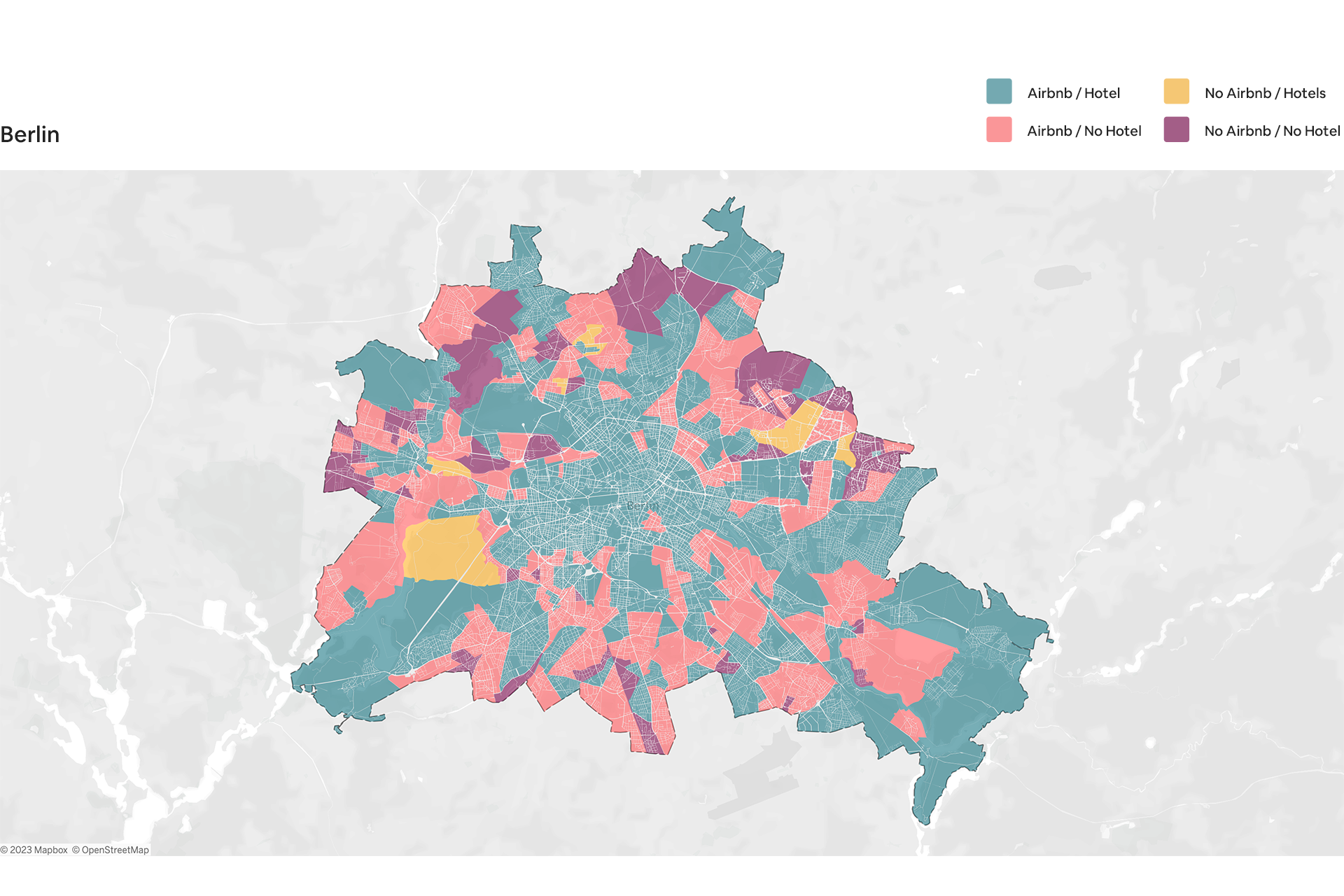

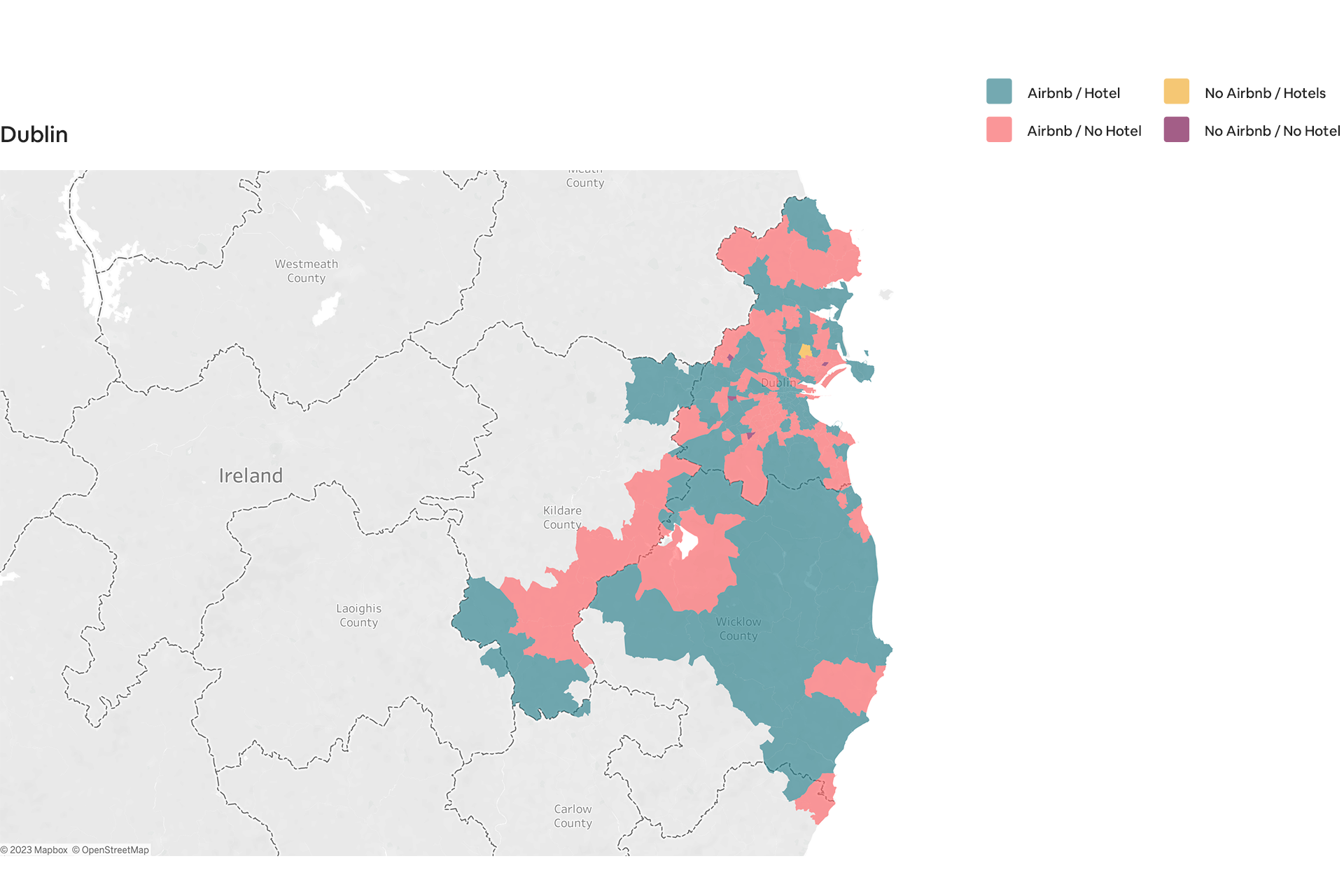

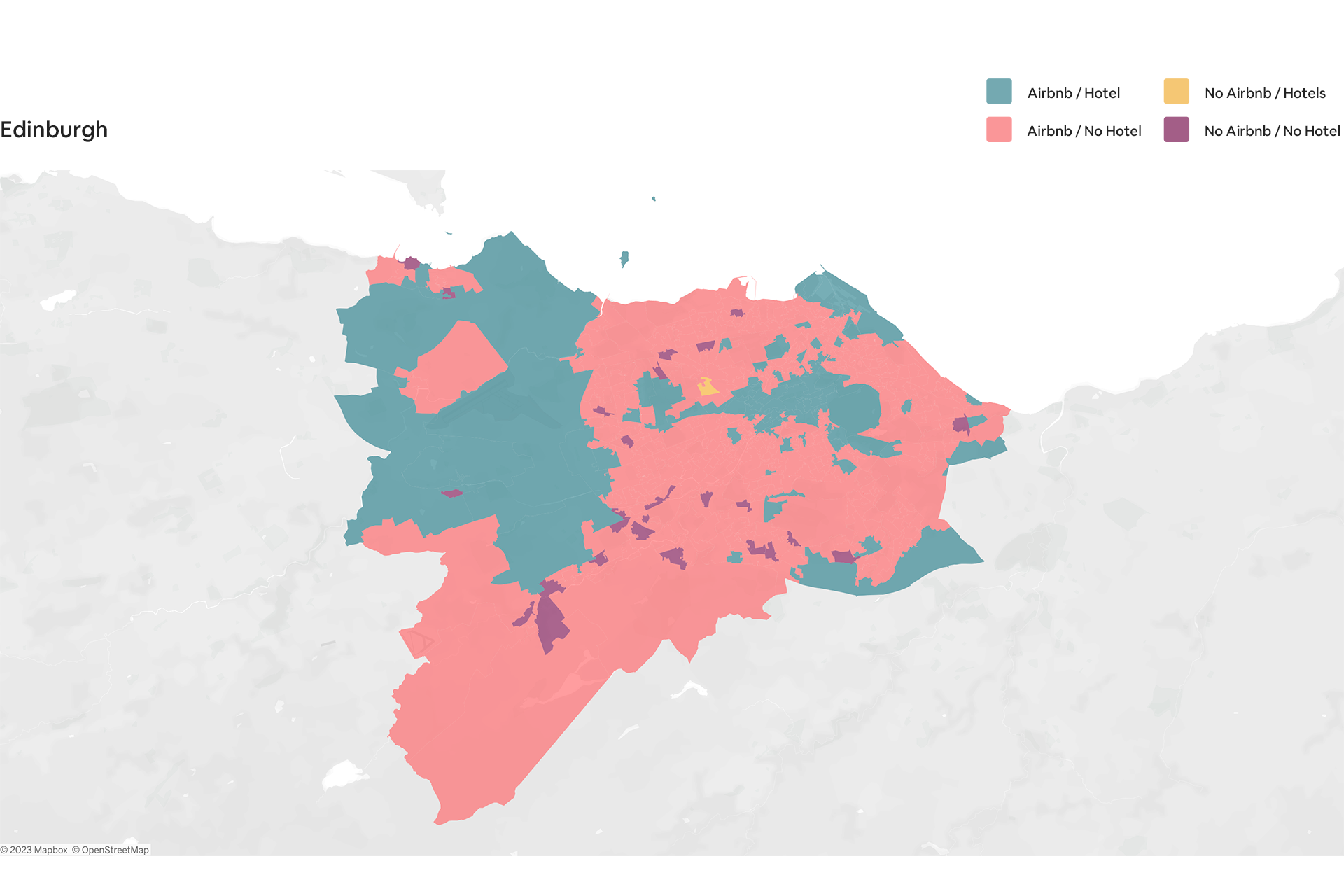

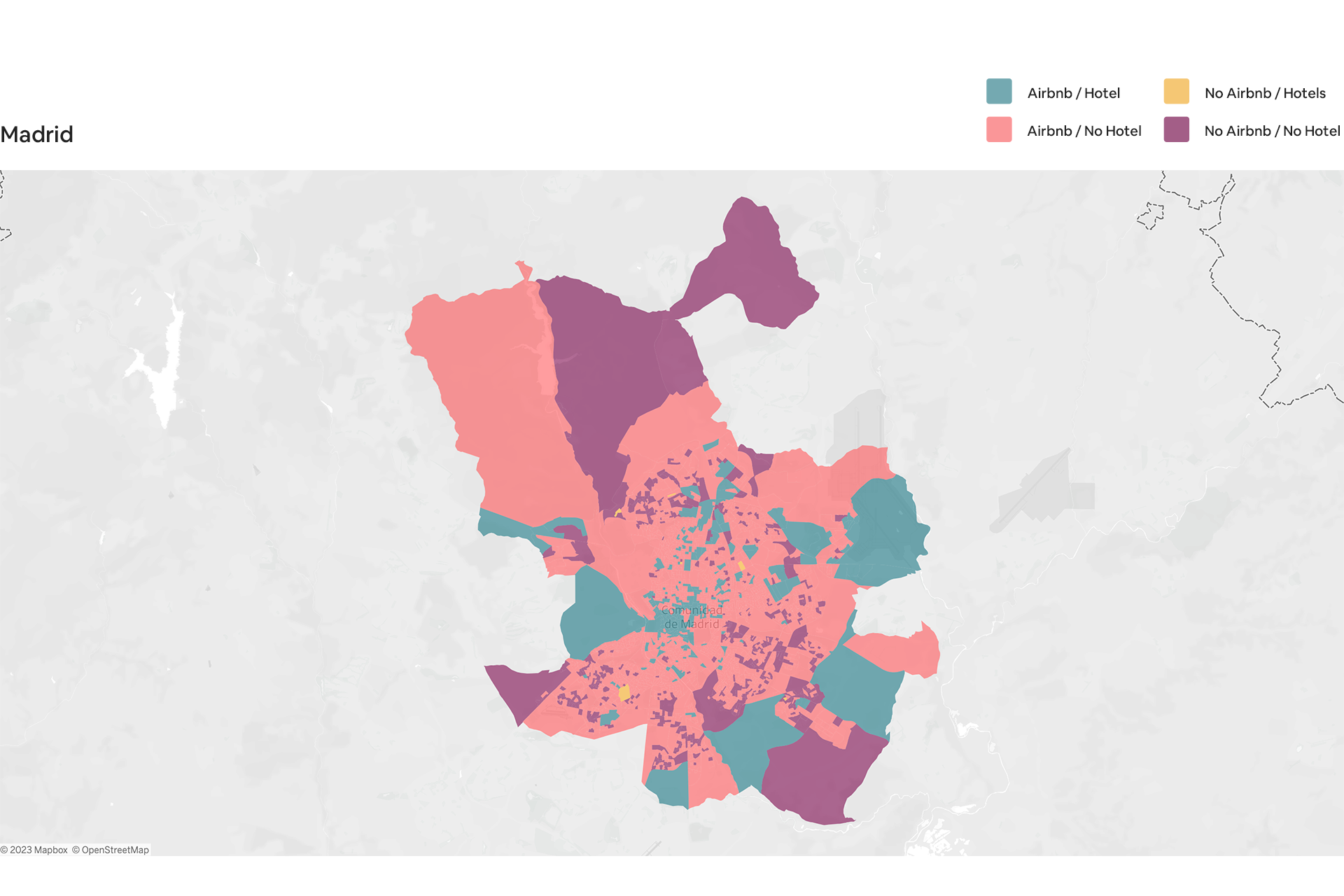

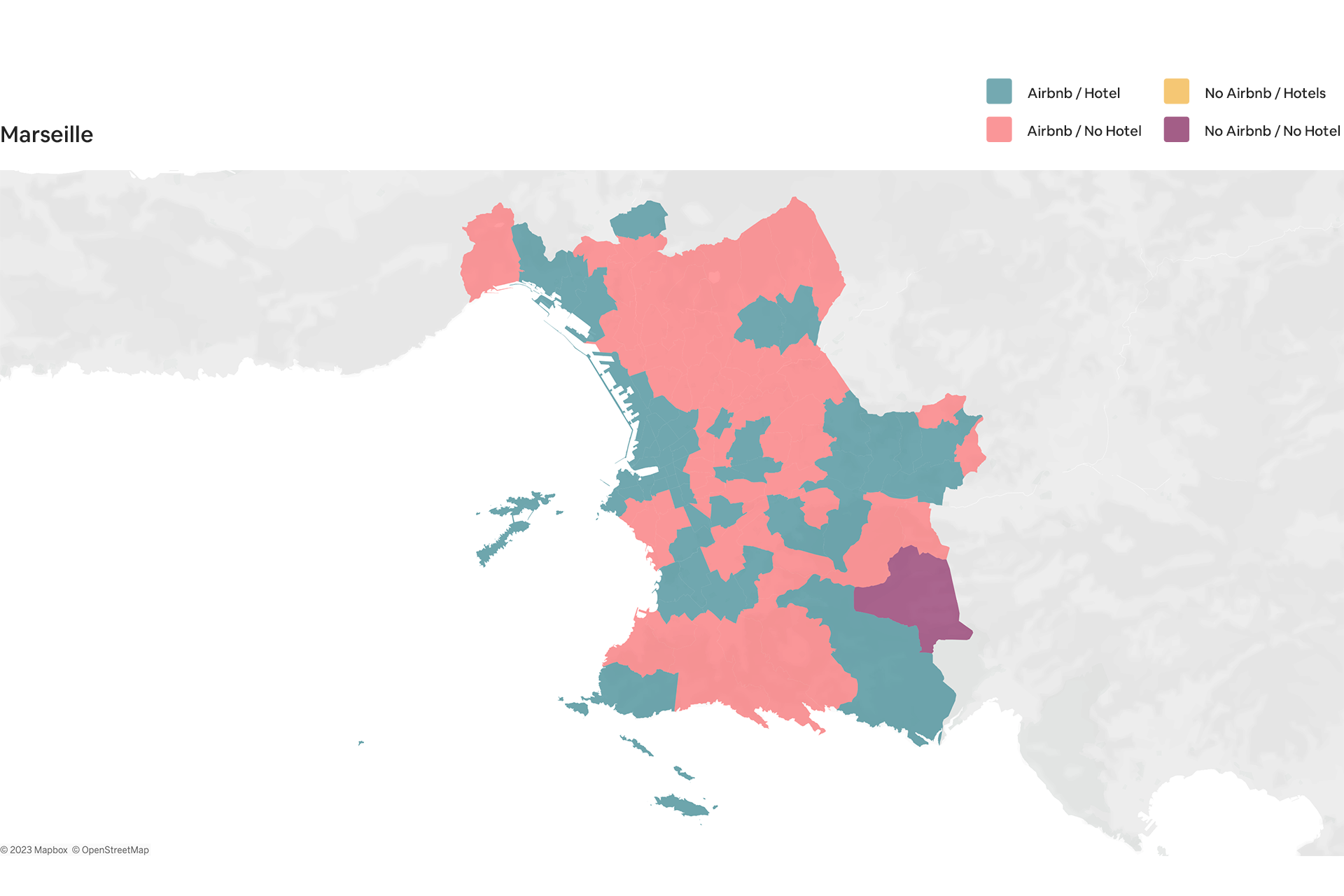

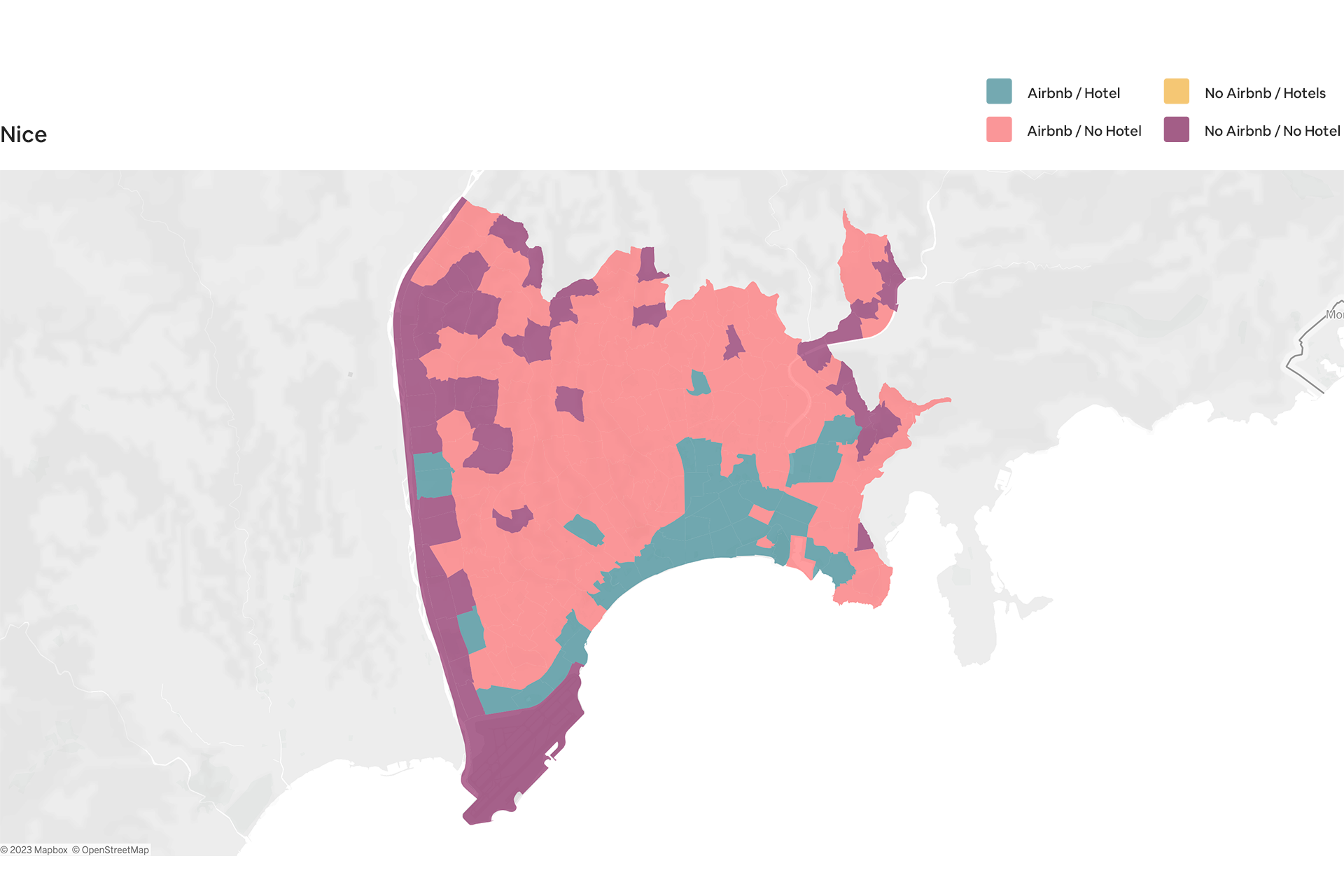

New data visuals also highlight how hotels tend to be clustered in the most over-touristed parts of cities, while listings on Airbnb are dispersed beyond tourist hotspots to areas that locals call home, generating new income for families, businesses and communities that have not typically benefited from tourism.

- In Amsterdam, there were more than 135,000 guest arrivals in areas with Airbnbs and no hotels, with local Hosts earning more than $33 million

- In Barcelona, there were over 450,000 guest arrivals in areas with Airbnbs and no hotels, delivering more than $100 million to Hosts

- And in London, there were more than 1 million guest arrivals in parts of the city with no hotels, providing more than $300 million in Host earnings to locals11

As well as dispersing travel to new communities, the presence of Airbnb accommodation is helping guests access affordable stays in these cities.

- In Edinburgh, the average daily rate of stays in communities served by Airbnb and no hotels was around $155 compared to $211 in communities served also by hotels.

- In Madrid, the difference was around $35 per night

- In Dublin, the difference was almost $30 per night

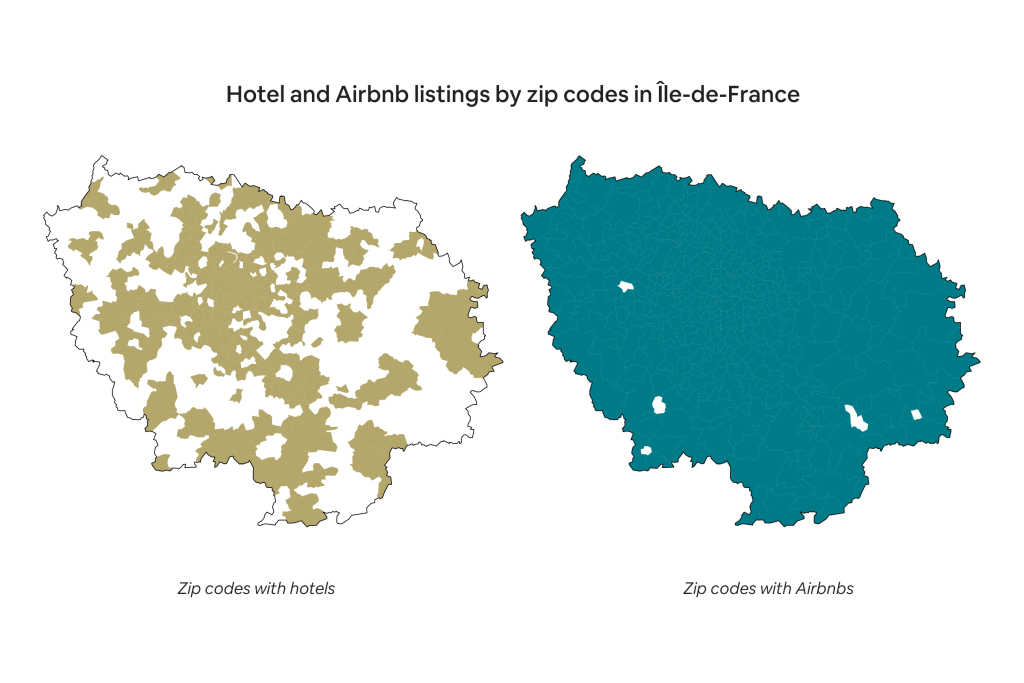

The positive impact of Airbnb on dispersing guests and travel benefits beyond hotel hotspots is seen not only in cities but for popular tourist regions too. In France’s most populous region, Ile-de-France, hotel supply was concentrated in half of the zip codes while Airbnb hosts offered accommodation in 99 percent of the zip codes, according to an analysis by Deloitte. The research also found that hotels tended to concentrate in areas with higher density and more economic activity while Airbnb covered a wider geographic area as shown in the comparison below.

New and trending neighborhoods in Europe

Guests on Airbnb are embracing travel dispersal and venturing far and wide to enjoy authentic travel experiences in unique and undiscovered destinations. As well as dispersing guests and benefits to communities with no hotels, Airbnb is helping guests discover new and trending neighborhoods offering a more authentic and local experience, while spreading the benefits of tourism to local artisanal businesses.

Looking at the growth in nights booked in European city neighborhoods, here are some top trending urban communities for guests seeking more authentic travel experiences, beyond tourist hotspots12:

- Volewijck, Amsterdam, The Netherlands

- Prinses Irenebuurt, Amsterdam, The Netherlands

- Campolide, Lisbon, Portugal

- Bexley, London, United Kingdom

- Havering, London, United Kingdom

- Nou Barris, Barcelona, Spain

- Marzahn-Hellersdorf, Berlin, Germany

Tech-driven solutions to disperse travel

Airbnb wants to be part of the solution to challenges associated with the growth of tourism in Europe and is investing in tech-driven solutions to help. New data released today shows the continued positive impact of Airbnb’s flexible search features, including Airbnb Categories and I’m Flexible, on diverting bookings away from Europe’s most saturated tourist hotspots in support of more sustainable travel trends.

New global data shows that guests booking stays using Airbnb’s flexible search features are significantly less likely to stay in the most popular destinations on Airbnb, compared to those booking via traditional search13. Around 1 in 20 stays on Airbnb are currently booked using flexible search features.

- Flexible bookers are 23% less likely to stay in the top 20 destinations on Airbnb

- Flexible bookers are 18% less likely to stay in the top 50 destinations on Airbnb

Airbnb’s flexible search features are also helping disperse guests within Europe’s most popular cities beyond popular tourist hotspots to traditionally less visited communities:

- In Amsterdam, flexible bookers more often stay outside the city’s inner limits (+40%) compared to traditional bookers.

- In Barcelona, flexible bookers are less likely to book in the two most popular areas of Eixample and Ciutat Vella than traditional bookers (respectively, -12.5% and -11%)

- In Lisbon, flexible bookers are more likely to stay outside of the city centre compared to traditional bookers (+64%) and less likely to stay in the most touristic districts of Santa Maria Major and Mesericordia (respectively, -23% and -16%).

- In London, flexible bookers are more likely to stay outside of the City of London (+30% compared to traditional bookers) and less likely to stay in the most popular districts of Westminster and Camden (respectively, -20% and -15%).

- In Prague, flexible bookers are less likely to book in the busy central District 1 area than traditional bookers (by -17%).

- In Rome, flexible bookers are less likely to book in the busy central District 1 area than traditional bookers (by -8%).

- In Paris, flexible bookers more often stay outside the city’s inner limits (+2.5%) compared to traditional bookers.

“Travel on Airbnb is more dispersed than ever and with summer on the horizon, we are helping guests return to cities in a sustainable way. Airbnb is helping disperse guests, income and tourism benefits beyond hotel hotspots to new and trending destinations, including many with no hotels. We see the challenges posed by hotel-driven mass tourism trends in Europe and are investing in solutions to help, while helping guests discover new communities and generating new income streams for locals.”

Juliette Langlais