How Airbnb disperses travel across cities and towns in Canada

Key Takeaways

- Nearly half of Canada is home to Airbnb listings but no hotels, where our Hosts are the primary—if not the only—providers of local accommodation and drivers of local tourism.

- With more than $1.5 billion collectively earned by Canadian Hosts in areas with no hotels in 2022, Hosts and guests emerge as key drivers of economic activity in areas not served by traditional hospitality.

- Nearly 70% of Toronto and 80% of Vancouver are served by Airbnb listings but no hotels.

Key Takeaways

- Nearly half of Canada is home to Airbnb listings but no hotels, where our Hosts are the primary—if not the only—providers of local accommodation and drivers of local tourism.

- With more than $1.5 billion collectively earned by Canadian Hosts in areas with no hotels in 2022, Hosts and guests emerge as key drivers of economic activity in areas not served by traditional hospitality.

- Nearly 70% of Toronto and 80% of Vancouver are served by Airbnb listings but no hotels.

The pandemic caused an unprecedented 70 percent hit to global tourism1, followed by a profound shift in how and when people travelled. As people became less tethered and more flexible, they were travelling anytime, to more places, and staying longer.

Even as people return to cities and their favourite overseas destinations post-pandemic, we’re seeing these trends of more distributed travel persist, to the benefit of smaller cities, small towns and off-the-beaten-path urban neighbourhoods across Canada.

Distributed travel is sustainable, affordable, boosts local economies and local jobs, and immerses people in these communities — whereas traditional travel tends to concentrate tourism economically and geographically, causing overcrowding, congestion and tensions between people and the places they’re visiting.

With this report, Airbnb is releasing new data on how the platform is supporting more sustainable, more affordable, more immersive travel by dispersing guests and benefits within cities and beyond oversaturated tourist hotspots to new and trending communities with few or no hotels, where our Hosts may be the primary—if not the only—providers of local accommodation and drivers of local tourism.

Dispersing travel through Airbnb

In 2022, Canadian Hosts on Airbnb welcomed more than 2.2 million guest arrivals to areas where there are no hotels2, generating more than $1.5 billion CAD in Host earnings and still more in economic activity driven by guest spending, based on a first-ever analysis of Airbnb and OpenStreetMap3 data. These are economic benefits circulating in communities that may not exist if not for Airbnb listings providing the opportunity for guests to stay and spend in local diners, shops, tours, museums, and attractions across these smaller cities and towns.

According to data studied by Airbnb, in 2022, listings existed with no hotel presence in nearly 50 percent of Canada’s dissemination areas4. Meaning, guests have the ability to travel to many more places by using Airbnb, as compared to hotels that traditionally are located in higher-trafficked areas.

Travel dispersal creates microeconomies

During the pandemic, Airbnb helped to support many small cities and towns through guests who may not have visited were it not for the presence of Airbnb listings. We believe guest spending in these areas has created important microeconomics. As part of the report, we’re also releasing the top-booked cities and towns across Canada with their first Airbnb booking this year5.

Top-Booked Canadian cities and towns with their first Airbnb booking in Q1 2023

- Centreville, New Brunswick

- Maryfield, Saskatchewan

- Pinware, Newfoundland and Labrador

- Eatonia, Saskatchewan

- Neepawa, Manitoba

- Notre-Dame-de-Stanbridge, Quebec

- Saint-Ludger-de-Milot, Quebec

- Aquaforte, Newfoundland and Labrador

- English Harbour East, Newfoundland and Labrador

- Alice Beach, Saskatchewan

We’ve seen decreasing dominance of the traditionally top 10 most-visited cities on Airbnb globally, which accounted for 7 percent of all trips in 2022, compared to 10 percent in 2019. We’ve also seen increased non-urban travel, which accounted for the highest growth in supply and demand in nights booked in 2022 compared to 2019—the last full pre-pandemic travel year.

As travel spreads to new places, we continue to work with policymakers and local governments across Canada and around the world towards fair regulations that balance the benefits of home sharing with the unique needs of each community.

Urban Renaissance: city nights spike

As we put the pandemic behind us, more travellers are returning to cities on Airbnb. We have seen a renewed interest in urban travel, with a 20 percent increase in high-density urban nights booked on Airbnb in Q1 2023 compared to Q1 2022. And nearly half of nights booked in Q1 2023 globally were in high-density urban destinations.

Airbnb offers urban travellers many options outside of traditional tourist districts, often at a more affordable price.

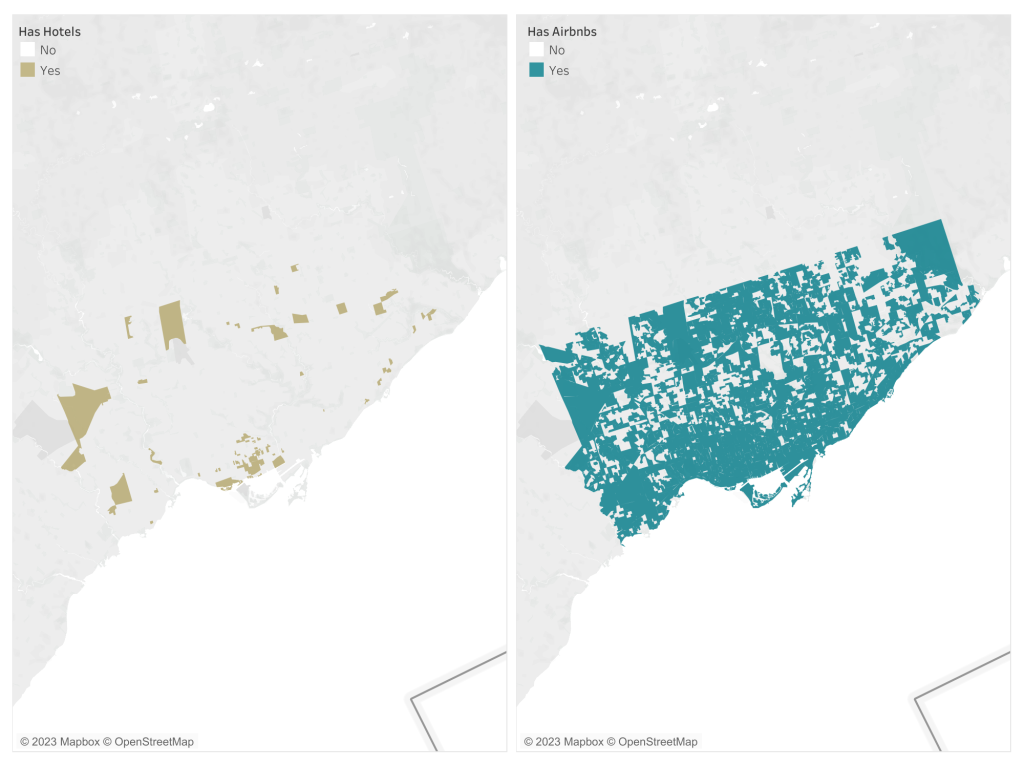

Toronto areas with hotels vs. Toronto areas with Airbnb

In Toronto, nearly 70 percent of the city is home to Airbnb listings but no hotel presence6 showing that Airbnb is helping to disperse travel beyond high-traffic areas and tourism hubs found in the downtown core. And when it comes to affordability, Average Daily Rate (ADR) for Airbnb listings in areas with no hotels were about 40 percent lower than areas with hotels, offering more affordable stays in more communities across the city7.

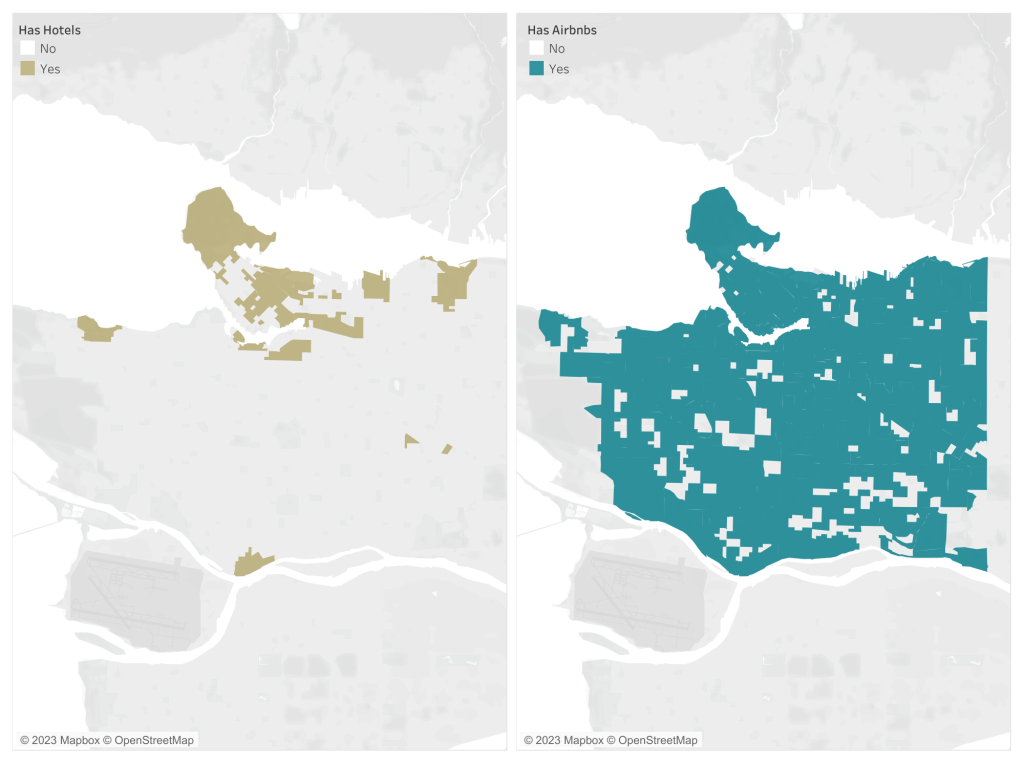

Vancouver areas with hotels vs. Vancouver ares with no Airbnbs

In Vancouver, Airbnb listings in areas without hotels represent more than 80 percent of the city with the ADR for Airbnb listings in neighbourhoods with no hotels more than 12 percent lower than areas with hotels – the equivalent of guests saving on sales tax in the city8.

Tech-driven solutions help disperse travel

Airbnb wants to help cities navigate the challenges associated with the growth of tourism and is investing in tech-driven solutions to help. New data demonstrates the continued positive impact of Airbnb’s flexible search features on diverting bookings away from cities’ most saturated tourist hotspots in support of more sustainable travel trends. Around one in 20 stays on Airbnb are currently booked using flexible search features. For example, an analysis of Toronto shows that users who booked stays using the flexible search features, are more likely to stay in the outskirts and less likely to book in the tourist neighborhoods compared with traditional bookers.

- In Toronto, for example, flexible bookers are less likely to book downtown in Spadina-Fort York and Toronto Centre (approximately 15% less likely) and more likely to stay outside the downtown core (approximately 10% more likely).

Hosts and guests on our platform remain at the forefront of the evolving hospitality industry. And the end result is a healthier economy for communities and a tourism ecosystem reflective of how we travel now and in the future.